DEF 14C: Definitive information statements

Published on March 18, 2021

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

INFORMATION STATEMENT

PURSUANT TO SECTION 14 (C)

OF THE

SECURITIES EXCHANGE ACT OF 1934

Check the appropriate box:

| ☐ | Preliminary Information Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d) (2) |

| ☒ | Definitive Information Statement |

| (Exact name of registrant as specified in its charter) |

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14(c)-5(g) and 0-11. |

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount of which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

1) Amount Previously Paid:

2) Form, Schedule or Registration No.:

3) Filing Party:

4) Date Filed

48 South Service Road

Melville, NY 11747

(212) 564-4922

March 18, 2021

NOTICE OF ACTION BY WRITTEN CONSENT OF STOCKHOLDERS

To the Stockholders of Data Storage Corporation:

This Information Statement is furnished to the stockholders of Data Storage Corporation., a Nevada corporation (“Data Storage” or the “Company”), in connection with the Company’s receipt of approval by written consent, in lieu of a meeting, on March 8, 2021, from the record holders (the “Consenting Stockholders”) of an aggregate of 101,553,187 shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”), constituting approximately 78% of the Company’s issued and outstanding voting capital stock (based on 128,539,418 shares of Common Stock and 1,401,786 shares of Series A Preferred Stock, par value $0.001 per share (the “Series A Preferred Stock”) issued and outstanding as of March 8, 2021 therein approving the following actions:

| (1) | An amendment (the “Reverse Stock Split Amendment”) to our articles of incorporation, as amended (the “Articles of Incorporation”), to effect a reverse stock split of our issued and outstanding shares of common stock, at a ratio to be determined at the discretion of the Board of Directors within a range of one (1) share of common stock for every two (2) to sixty (60) shares of common stock (the “Reverse Stock Split”), such amendment to be effected only in the event the Board of Directors still deems it advisable; |

| (2) | Approval of the Data Storage Corporation 2021 Stock Incentive Plan (the “2021 Plan”); |

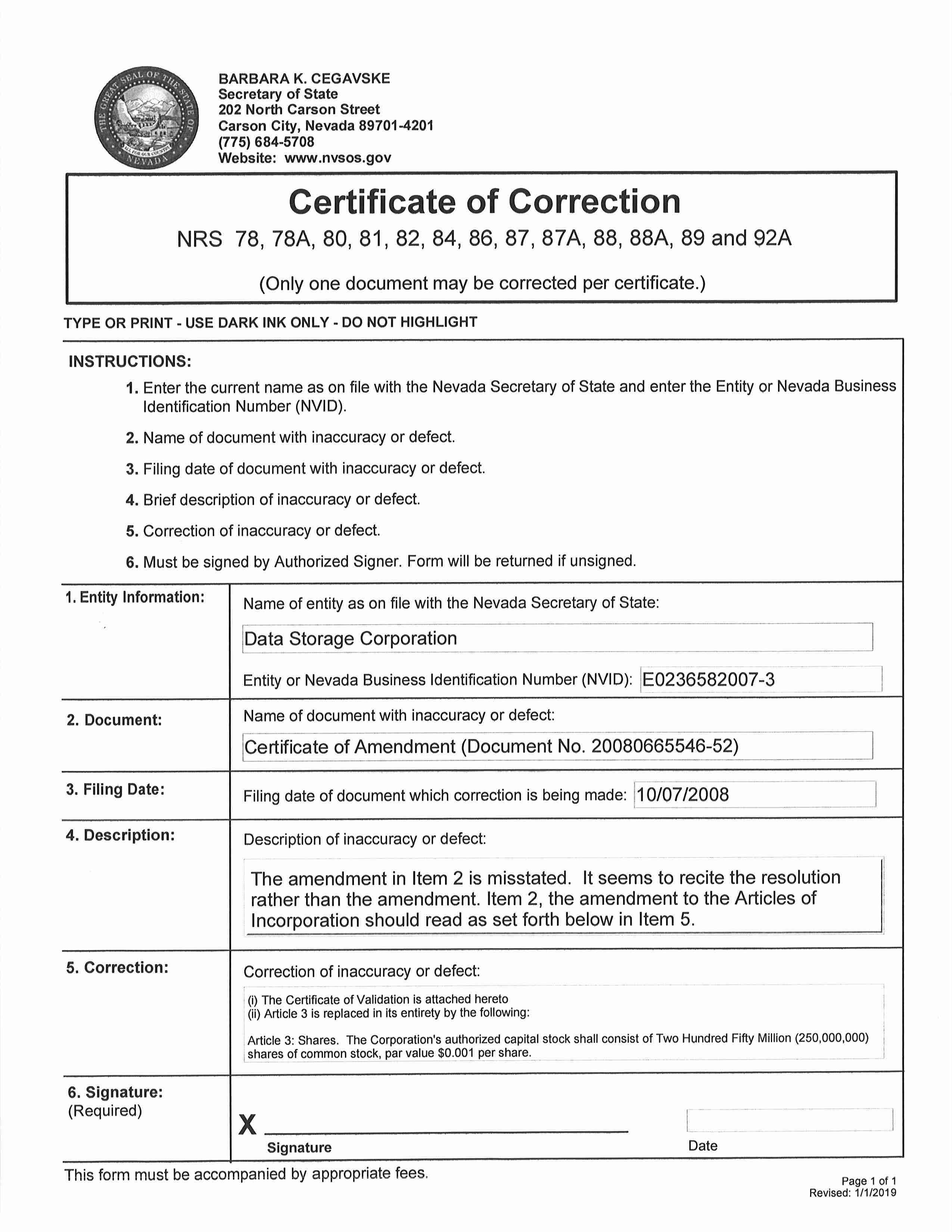

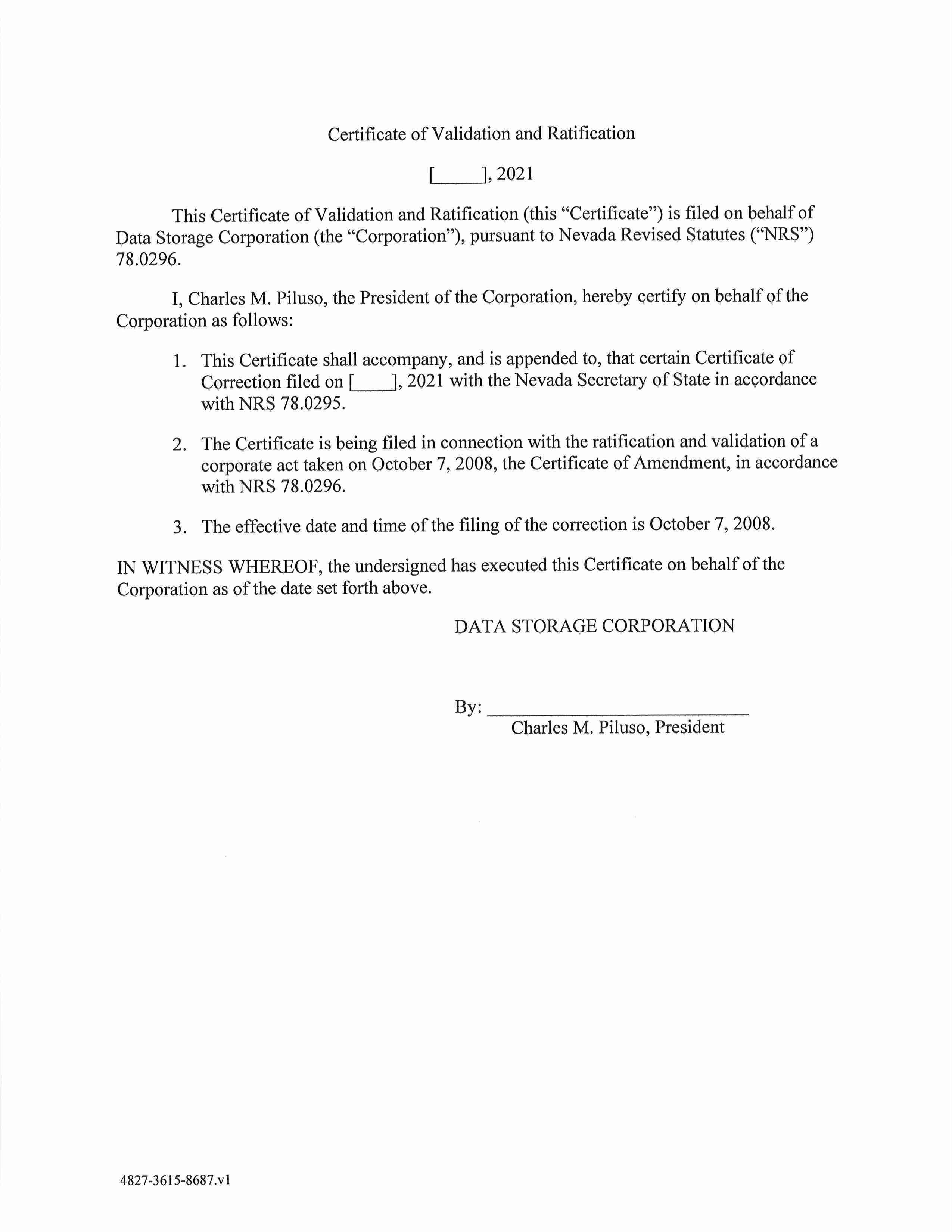

| (3) | Ratification and approval of the Certificate of Correction and Certificate of Validation to the Certificate of Amendment to the Articles of Incorporation filed with the Secretary of State of the State of Nevada on October 7, 2008; |

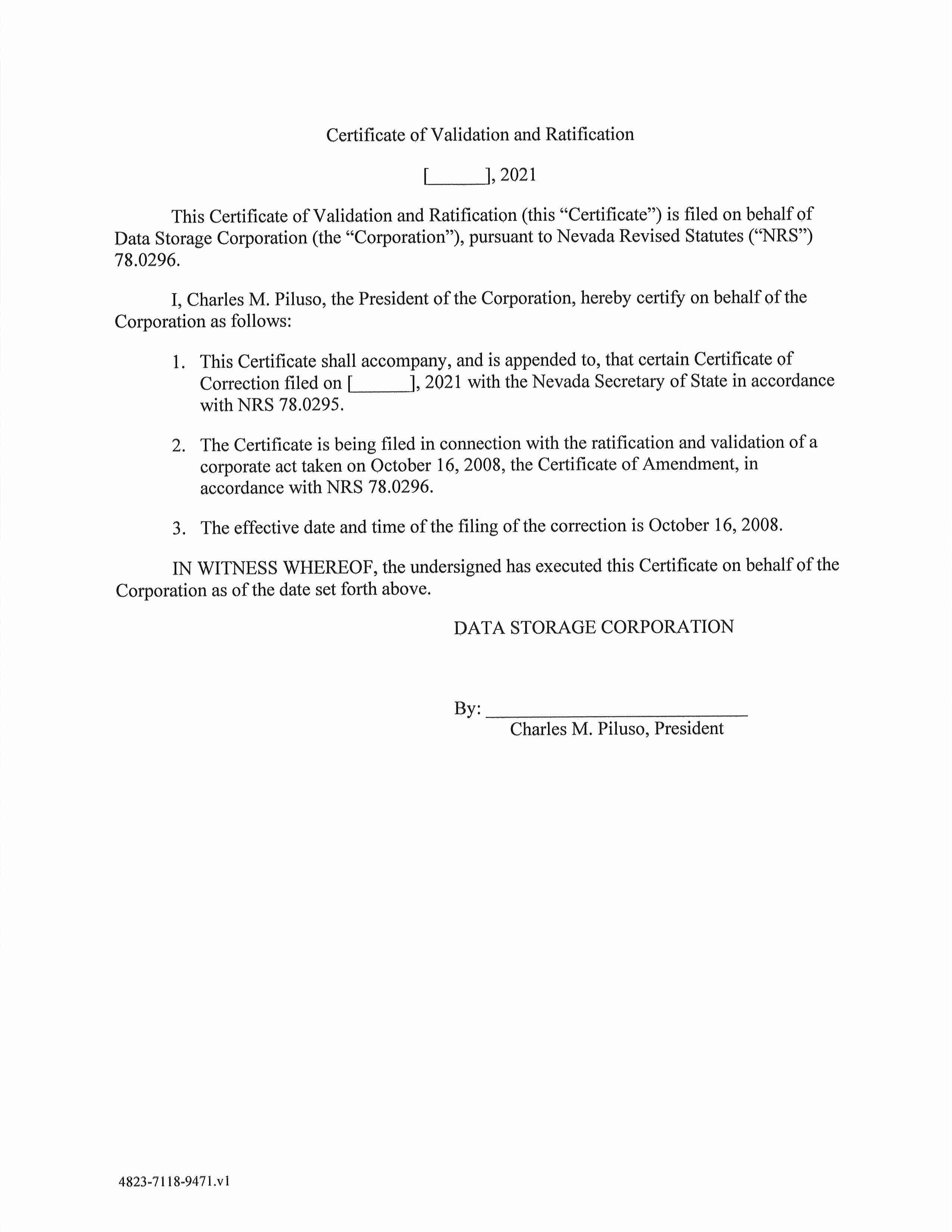

| (4) | Ratification and approval of the Certificate of Correction and Certificate of Validation to the Certificate of Amendment to the Articles of Incorporation filed with the Secretary of State of the State of Nevada on October 16, 2008; |

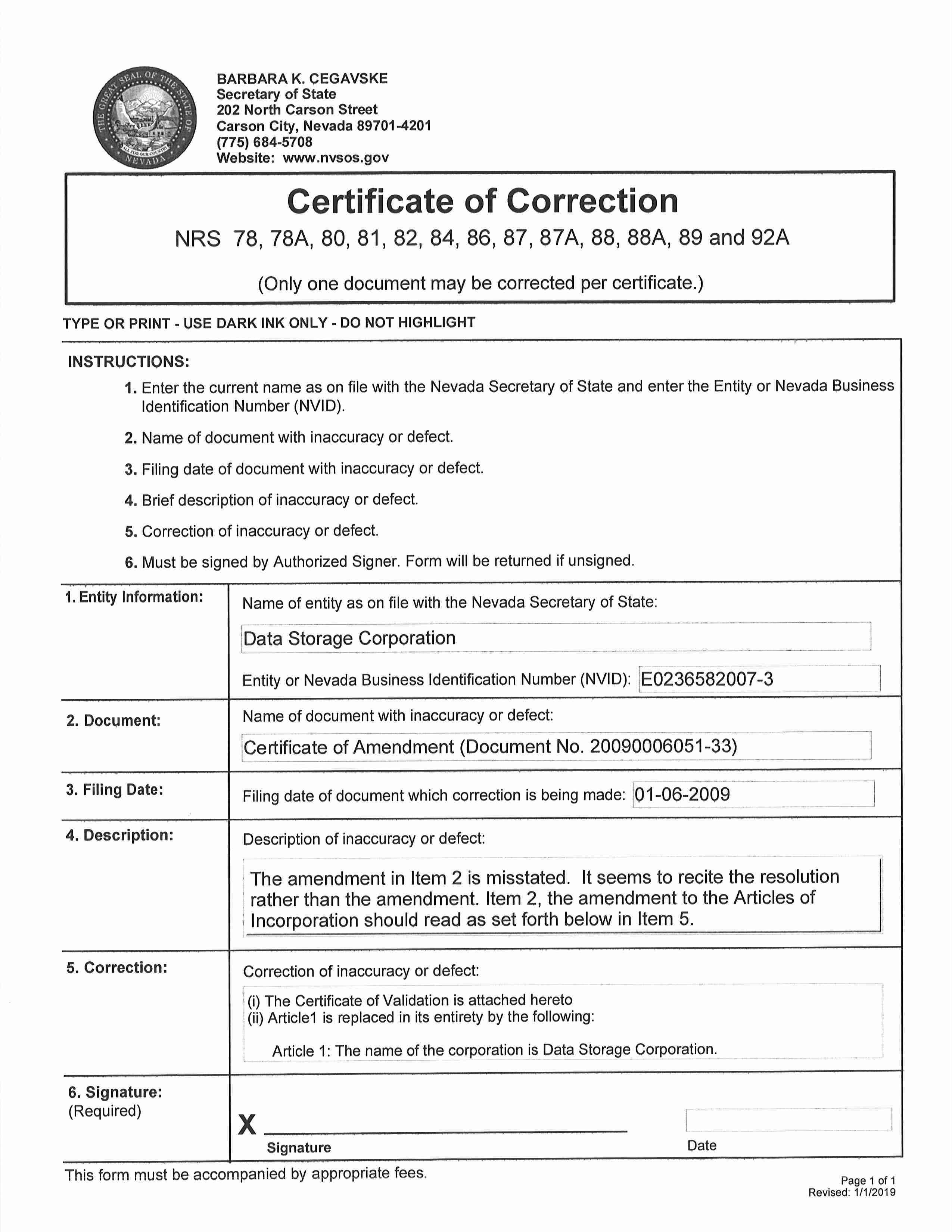

| (5) | Ratification and approval of the Certificate of Correction and Certificate of Validation to the Certificate of Amendment to the Articles of Incorporation filed with the Secretary of State of the State of Nevada on January 6, 2009; and |

| (6) | Ratification and approval of the Certificate of Designation of the Series A Preferred Stock filed with the Secretary of State of the State of Nevada on June 24, 2009 (the “Certificate of Designation”), the issuance of 1,401,786 shares of Series A Preferred Stock thereunder, and the Certificate of Correction and Certificate of Validation to the Certificate of Designation. |

A copy of the Reverse Stock Split Amendment is attached to this information statement as Appendix A, a copy of the 2021 Plan is attached to this information statement as Appendix B, copies of the Certificates of Correction and Certificates of Validation to the Certificates of Amendment to Articles of Incorporation filed on October 7, 2008, October 16, 2008 and January 6, 2009 are attached to this information statement as Appendix C, Appendix D, and Appendix E respectively, and a copy of the Certificate of Correction and Certificate of Validation to the Certificate of Designation filed on June 24, 2009 is attached hereto as Appendix F.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

Because the written consent of the holders of a majority of our voting power satisfies all applicable stockholder voting requirements, we are not asking for a proxy. Please do not send us one.

Pursuant to Rule 14c-2 under the Exchange Act, the Reverse Stock Split Amendment and Certificates of Correction and Certificates of Validation will not be filed with the Secretary of State of the State of Nevada and no issuances under the 2021 Plan will be made until at least twenty (20) calendar days after the mailing of this Information Statement. This Information Statement is expected to be mailed on or about March 18, 2021 to stockholders of record on the Record Date.

The entire cost of furnishing the Information Statement and related materials will be borne by the Company. The Company will request brokerage houses, nominees, custodians, fiduciaries, and other like parties to forward the Notice to the beneficial owners of the Common Stock held of record by them. The Company’s Board of Directors (the “Board of Directors”) has fixed the close of business on March 8, 2021 as the record date (the “Record Date”) for the determination of stockholders who are entitled to receive this Information Statement.

The accompanying Information Statement is for information purposes only. Please read it carefully.

By Order of the Board of Directors,

|

/s/ Charles M. Piluso |

|

| Charles M. Piluso | |

| Chairman and Chief Executive Officer, Director | |

| (Principal Executive Officer) |

Melville, New York

March 18, 2021

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

Pursuant to the Company’s Bylaws and the Nevada Revised Statutes, a vote by the holders of at least a majority of the Company’s outstanding voting power is required to affect the Reverse Stock Split Amendment and the adoption of the Plan, and to ratify and approve each of the Certificates of Correction and Certificates of Validation, the Certificate of Designation of the Series A Preferred Stock as filed on June 24, 2009 with the Secretary of State of Nevada and the issuance of 1,401,786 shares of Series A Preferred Stock thereunder. The Board of Directors fixed the close of business on March 8, 2021 as the Record Date for the determination of the stockholders entitled to notice of the action by written consent.

As of the Record Date, Data Storage had 128,539,418 shares of common stock outstanding and 1,401,786 shares of Series A Preferred Stock outstanding. The holders of shares of common stock and Series A Preferred Stock, on a converted to common stock basis, are entitled to one vote per share and vote together on all matters to be voted upon by the holder of shares of Common Stock.

On the Record Date, the Consenting Stockholders were entitled to 101,553,187 votes, which represented approximately 78% of the voting power of the issued and outstanding shares of common stock and Series A Preferred Stock eligible to vote on the Record Date. The Consenting Stockholders voted in favor of the Amendment described herein in a written consent, dated March 8, 2021, in lieu of a meeting of stockholders as permitted by Nevada Revised Statues and the Bylaws of the Company.

1

THE REVERSE STOCK SPLIT

Pursuant to the authorization and approval of the Consenting Stockholders, by written consent dated March 8, 2021, the Board of Directors has been granted the authority to effect a reverse stock split of the Company’s common stock, as described below (the “Reverse Stock Split”). If the Board of Directors decides to implement the Reverse Stock Split, it will become effective through an amendment to our Articles of Incorporation (the “Reverse Stock Split Amendment”). The proposed form of the Reverse Stock Split Amendment to effect the Reverse Stock Split is attached as Appendix A to this Information Statement.

The Reverse Stock Split Amendment permits (but does not require) the Board of Directors to effect a reverse stock split of the Company’s common stock by a ratio of a range of one-for-two (1:2) to one-for-sixty (1:60), such that a range of every two (2) to sixty (60) shares of issued and outstanding shares of common stock will be converted into one (1) share of common stock. If the Board of Directors does not implement the Reverse Stock Split prior to March 8, 2022, the Board of Directors will seek stockholder approval before implementing any Reverse Stock Split after that time. The Board of Directors reserves the right to elect to abandon the Reverse Stock Split if it determines, in its sole discretion, that the Reverse Stock Split is no longer in our best interests and the best interests of our stockholders. In fixing the ratio, the Board of Directors may consider, among other things, factors such as: the initial and continued listing requirements of the Nasdaq Capital Market (“Nasdaq”); the number of shares of our common stock outstanding; potential financing opportunities; and prevailing general market and economic conditions.

The Reverse Stock Split will not affect the number of authorized shares of our common stock or our preferred stock.

Background and Reasons for the Reverse Stock Split; Potential Consequences of the Reverse Stock Split

We believe that the Reverse Stock Split will enhance our ability to obtain an initial listing on Nasdaq. One of Nasdaq listing requirements is that the bid price of our common stock is at a specified minimum per share (the “Minimum Bid Price”). Reducing the number of outstanding shares of our common stock should, absent other factors, result in an increase in the per share market price of our common stock, although we cannot provide any assurance that our minimum bid price would, following the Reverse Stock Split, remain over the Minimum Bid Price requirement of Nasdaq.

In addition, with a high number of issued and outstanding common shares, the price per each share of our common stock may be too low for the Company to attract investment capital on reasonable terms for the Company. We believe that the Reverse Stock Split will make our common stock more attractive to a broader range of institutional investors, professional investors and other members of the investing public. Many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. In addition, some of those policies and practices may function to make the processing of trades in low-priced stocks economically unattractive to brokers. Moreover, because brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, the current average price per share of common stock can result in individual stockholders paying transaction costs representing a higher percentage of their total share value than would be the case if the share price were substantially higher. We believe that the Reverse Stock Split may make our common stock a more attractive and cost-effective investment for many investors, which may enhance the liquidity of the holders of our common stock.

Although reducing the number of outstanding shares of our common stock through the Reverse Stock Split is intended, absent other factors, to increase the per share market price of our common stock, other factors, such as our financial results, market conditions and the market perception of our business, may adversely affect the market price of our common stock. As a result, there can be no assurance that the Reverse Stock Split, if completed, will result in the intended benefits described above, or that the market price of our common stock will increase (proportionately to the reduction in the number of shares of our common stock after the Reverse Stock Split or otherwise) following the Reverse Stock Split or that the market price of our common stock will not decrease in the future.

Procedure for Implementing the Reverse Stock Split

The Reverse Stock Split will become effective upon the filing (the “Split Effective Time”) of Reverse Stock Split Amendment, with the Secretary of State of the State of Nevada, which will not be filed prior to the expiration of the twenty (20) day waiting period pursuant to Rule 14c-2 under the Exchange Act. The exact timing of the filing of the Reverse Stock Split Amendment that will affect the Reverse Stock Split will be determined by the Board of Directors based on its evaluation as to when such action will be the most advantageous to us and our stockholders. The Reverse Stock Split further is expected to be implemented in connection with, and at the time of, the proposed listing of our common stock on a national securities exchange. In addition, the Board of Directors reserves the right to elect not to proceed with the Reverse Stock Split if, at any time prior to filing the Reverse Stock Split Amendment, the Board of Directors, in its sole discretion, determines that it is no longer in our best interests and the best interests of our stockholders to proceed with the Reverse Stock Split.

Effect of the Reverse Stock Split on Holders of Outstanding Common Stock

Upon the Split Effective Time, the number of shares of common stock issued and outstanding will be reduced, depending upon the ratio determined by our Board of Directors within a range of 1:2 to 1:60. Fractional shares will not be issued. Instead, we will issue a full share of post-Reverse Stock Split common stock to any stockholder who would have been entitled to receive a fractional share of common stock as a result of the Reverse Stock Split. In other words, we will “round up” fractional shares.

2

The Reverse Stock Split will affect all holders of our common stock uniformly and will not affect any stockholder’s percentage ownership interest in us, except to the extent the Reverse Stock Split would result in fractional shares, as described above The Reverse Stock Split will not change the terms of the common stock. Additionally, the Reverse Stock Split will have no effect on the number of common stock that we are authorized to issue. After the Split Effective Time, the shares of common stock will have the same voting rights and rights to dividends and distributions (other than fractional shares) and will be identical in all other respects to the common stock now authorized. The issued common stock will remain fully paid and non-assessable.

After the Split Effective Time, our common stock will have a new Committee on Uniform Securities Identification Procedures (CUSIP) number, which are numbers used to identify our equity securities, and stockholders holding physical stock certificates with the older CUSIP numbers should exchange those stock certificates for stock certificates with the new CUSIP numbers by following the procedures enumerated in the letter of transmittal to be sent to our stockholders, as described below. Stockholders holding common stock in street name do not have to take any action, as the split will occur automatically on the Split Effective Time, as described below.

Notwithstanding the decrease in the number of outstanding shares of common stock following the proposed Reverse Stock Split, the Board does not intend for this transaction to be the first step in a “going private transaction” within the meaning of Rule 13e-3 under the Securities Exchange Act of 1934.

Because the number of authorized shares of our common stock will not be reduced, an overall effect of the Reverse Stock Split of the outstanding common stock will be an increase in authorized but unissued shares of our common stock. These shares may be issued by our Board in its sole discretion. See “Anti-Takeover Effects of the Reverse Stock Split” below. Any future issuance will have the effect of diluting the percentage of stock ownership and voting rights of the present holders of our common stock and preferred stock.

Beneficial Holders of Common Stock (i.e., stockholders who hold in street name)

Upon the implementation of the Reverse Stock Split, we intend to treat shares held by stockholders through a bank, broker, custodian or other nominee in the same manner as registered stockholders whose shares are registered in their names. Banks, brokers, custodians, or other nominees will be instructed to affect the Reverse Stock Split for their beneficial holders holding our common stock in street name. However, these banks, brokers, custodians, or other nominees may have different procedures than registered stockholders for processing the Reverse Stock Split. Stockholders who hold shares of our common stock with a bank, broker, custodian, or other nominee and who have any questions in this regard are encouraged to contact their banks, brokers, custodians, or other nominees.

Registered “Book-Entry” Holders of Common Stock (i.e., stockholders that are registered on the transfer agent’s books and records but do not hold stock certificates)

Certain of our registered holders of common stock may hold some or all of their shares electronically in book-entry form with the transfer agent. These stockholders do not have stock certificates evidencing their ownership of the common stock. They are, however, provided with a statement reflecting the number of shares registered in their accounts.

Stockholders who hold shares electronically in book-entry form with the transfer agent will not need to take action (the exchange will be automatic) to receive shares of post-Reverse Stock Split common stock.

Exchange of Stock Certificates and Elimination of Fractional Share Interests

We expect that the Transfer Agent will act as the exchange agent for the purposes of implementing the exchange of stock certificates in connection with the Reverse Stock Split. As soon as practicable after Split Effective Time, the stockholders holding common stock in certificated form will be sent a letter of transmittal by the Transfer Agent. The letter of transmittal will contain instructions on how a shareholder should surrender his, her or its certificates representing pre-split shares of our common stock to the Transfer Agent in exchange for certificates representing post-split shares. No new certificates will be issued to a shareholder until that shareholder has surrendered the certificate(s) representing the outstanding pre-Reverse Stock Split shares together with the properly completed and executed letter of transmittal.

Stockholders should not destroy any stock certificate(s) and should not submit any stock certificate(s) until requested to do so.

Effect of the Reverse Stock Split on Holders of Preferred Stock

In connection with the Reverse Stock Split, the conversion price of each share of Series A preferred stock, par value $0.001 per share (the “Series A Preferred Stock”), will be proportionately increased. Any fractional shares to be issued upon conversion of the Series A Preferred Stock, after aggregating all fractional shares, will be paid in cash. Accordingly, the proportional voting power of the outstanding shares of post-split Series A Preferred Stock relative the outstanding shares of post-split common stock will not change as a result of the Reverse Stock Split except to the extent of the treatment of fractional shares.

As of the Record Date, there were outstanding 1,401,786 shares of Series A Preferred Stock.

3

Fractional Shares

Fractional shares with respect to our common stock will not be issued in connection with the Reverse Stock Split. We will round up any fractional shares of our common stock resulting from the Reverse Stock Split to the nearest whole share.

Effect of the Reverse Stock Split on Employee Plans, Options, Restricted Stock Awards and Units, Warrants, and Convertible or Exchangeable Securities

Based upon the Reverse Stock Split ratio, proportionate adjustments are generally required to be made to the per share exercise price and the number of shares issuable upon the exercise of all outstanding options and warrants. This would result in approximately the same aggregate price being required to be paid under such options or warrants upon exercise, and approximately the same value of shares of common stock being delivered upon such exercise immediately following the Reverse Stock Split as was the case immediately preceding the Reverse Stock Split. The number of shares reserved for issuance pursuant to these securities will be reduced proportionately based upon the Reverse Stock Split ratio.

Anti-Takeover Effects of the Reverse Stock Split

The effective increase in our authorized and unissued shares as a result of the Reverse Stock Split could potentially be used by our Board to thwart a takeover attempt. The overall effects of this might be to discourage, or make it more difficult to engage in, a merger, tender offer or proxy contest, or the acquisition or assumption of control by a holder of a large block of our securities and the removal of incumbent management. The Reverse Stock Split could make the accomplishment of a merger or similar transaction more difficult, even if it is seemingly beneficial to our stockholders. Our Board might use the additional shares to resist or frustrate a third-party transaction, favored by a majority of the independent stockholders that would provide an above-market premium, by issuing additional shares to frustrate the takeover effort.

As discussed above, the principal goals of the Company in effecting the Reverse Stock Split are to increase the ability of institutions to purchase our common stock and stimulate the interest in our common stock by analysts and brokers as well as comply with certain Minimum Bid Price requirements to increase the likelihood of listing our common stock on a national securities exchange. This Reverse Stock Split is not the result of management’s knowledge of an effort to accumulate the Company’s securities or to obtain control of the Company by means of a merger, tender offer, solicitation or otherwise.

Neither our Articles of Incorporation nor our Bylaws presently contain any provisions having anti-takeover effects and the Reverse Stock Split proposal is not a plan by our Board to adopt a series of amendments to our Articles of Incorporation or Bylaws to institute an anti-takeover provision. We do not have any plans or proposals to adopt other provisions or enter into other arrangements that may have material anti-takeover consequences.

Plans for Newly Available Shares

Other than the contemplated registered public offering of our common stock and warrants to purchase our common stock, as discussed in more detail in the registration statement on Form S-1 filed on February 12, 2021 and the contemplated issuance of common stock in our proposed merger with Flagship Solutions, LLC, we presently have no specific plans, nor have we entered into any agreements, arrangements or understandings with respect to the shares of authorized common stock that will become available for issuance as a result of the Reverse Stock Split.

Accounting Matters

This proposed amendment to the Articles of Incorporation will not affect the par value of our common stock or Series A Preferred Stock per share. As a result, as of the Split Effective Time, the stated capital attributable to common stock and the additional paid-in capital account on our balance sheet will not change due to the Reverse Stock Split. Reported per share net income or loss will be higher because there will be fewer shares of common stock outstanding.

Interests of Officers and Directors in this Proposal

Other than the reduction in the number of shares of common stock held by them, which would result from the consummation of the Reverse Stock Split, which will be similar to the effect on all other holders of the Company’s shares of common stock, our officers and directors do not have any substantial interest, direct or indirect, in the Reverse Stock Split.

Certain Federal Income Tax Consequences of the Reverse Stock Split

The following summary describes certain material U.S. federal income tax consequences of the Reverse Stock Split to holders of our common stock.

4

Unless otherwise specifically indicated herein, this summary addresses the tax consequences only to a beneficial owner of our common stock that is a citizen or individual resident of the United States, a corporation organized in or under the laws of the United States or any state thereof or the District of Columbia or otherwise subject to U.S. federal income taxation on a net income basis in respect of our common stock (a “U.S. holder”). A trust may also be a U.S. holder if (1) a U.S. court is able to exercise primary supervision over administration of such trust and one or more U.S. persons have the authority to control all substantial decisions of the trust or (2) it has a valid election in place to be treated as a U.S. person. An estate whose income is subject to U.S. federal income taxation regardless of its source may also be a U.S. holder.

This summary does not address all of the tax consequences that may be relevant to any particular investor, including tax considerations that arise from rules of general application to all taxpayers or to certain classes of taxpayers or that are generally assumed to be known by investors. This summary also does not address the tax consequences to (i) persons that may be subject to special treatment under U.S. federal income tax law, such as banks, insurance companies, thrift institutions, regulated investment companies, real estate investment trusts, tax-exempt organizations, U.S. expatriates, persons subject to the alternative minimum tax, traders in securities that elect to mark to market and dealers in securities or currencies, (ii) persons that hold our common stock as part of a position in a “straddle” or as part of a “hedging,” “conversion” or other integrated investment transaction for federal income tax purposes, or (iii) persons that do not hold our common stock as “capital assets” (generally, property held for investment). If a partnership (or other entity classified as a partnership for U.S. federal income tax purposes) is the beneficial owner of our common stock, the U.S. federal income tax treatment of a partner in the partnership will generally depend on the status of the partner and the activities of the partnership. Partnerships that hold our common stock, and partners in such partnerships, should consult their own tax advisors regarding the U.S. federal income tax consequences of the Reverse Stock Split.

This summary is based on the provisions of the Internal Revenue Code of 1986, as amended (the “Code”), U.S. Treasury regulations, administrative rulings and judicial authority, all as in effect as of the date of this Information Statement. Subsequent developments in U.S. federal income tax law, including changes in law or differing interpretations, which may be applied retroactively, could have a material effect on the U.S. federal income tax consequences of the Reverse Stock Split.

PLEASE CONSULT YOUR OWN TAX ADVISOR REGARDING THE U.S. FEDERAL, STATE, LOCAL, AND FOREIGN INCOME AND OTHER TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT IN YOUR PARTICULAR CIRCUMSTANCES UNDER THE INTERNAL REVENUE CODE AND THE LAWS OF ANY OTHER TAXING JURISDICTION.

U.S. holders generally will not recognize gain or loss on the Reverse Stock Split. The aggregate tax basis of the post-split shares received will be equal to the aggregate tax basis of the pre-split shares exchanged, and the holding period of the post-split shares received will include the holding period of the pre-split shares exchanged.

No gain or loss will be recognized by us as a result of the Reverse Stock Split. As noted above, we will not issue fractional shares of our common stock in connection with the Reverse Stock Split. Instead, we will issue a full share of post-Reverse Stock Split common stock to any stockholder who would have been entitled to receive a fractional share of common stock as a result of the Reverse Stock Split. The U.S. federal income tax consequences of the receipt of such an additional share of our common stock are not clear. Our view regarding the tax consequences of the Reverse Stock Split is not binding on the Internal Revenue Service or the courts. Accordingly, each U.S. holder should consult with his or her own tax advisor with respect to all of the potential tax consequences to him or her of the Reverse Stock Split.

APPROVAL OF OUR 2021 STOCK INCENTIVE PLAN

Our Amended and Restated Data Storage Corporation 2010 Incentive Award Plan (the “2010 Plan”) expired on October 21, 2020, and no grants of awards under the 2010 Plan may be made after that date. Our 2008 Equity Incentive Award Plan (the “2008 Plan”) expired on February 3, 2013, and no grants of awards under the 2008 Plan may be made after that date. Our Board believes that it is in the best interests of the Company and its stockholders to have a new equity compensation plan adopted by the Board and approved by the stockholders so that the Company can continue to provide a means whereby eligible employees, officers, non-employee directors and other individual service providers develop a sense of proprietorship and personal involvement in the development and financial success of the Company and to encourage them to devote their best efforts to the business of the Company, thereby advancing the interests of the Company and its stockholders. Accordingly, on March 8, 2021, our Board approved and adopted the 2021 Stock Incentive Plan (the “2021 Plan”), and the Consenting Stockholders subsequently approved the 2021 Plan, by written consent dated March 8, 2021.

Approval of the 2021 Plan by the Company’s stockholders was required, among other things, in order to allow the grant to eligible employees of options that qualify as “incentive stock options” (or ISOs) under Section 422 of the Code and to comply with certain requirements for the listing of the Company’s common stock on the Nasdaq Capital Market.

Approval of the 2021 Plan by our stockholders allows us to grant stock options, restricted stock unit awards and other awards at levels determined appropriate by our Board and/or compensation committee. The 2021 Plan also allows us to utilize a broad array of equity incentives and performance cash incentives in order to secure and retain the services of our employees, directors and consultants, and to provide long-term incentives that align the interests of our employees, directors and consultants with the interests of our stockholders.

Purpose of the 2021 Plan

The Board of Directors believes that the 2021 Plan is necessary for us to attract, retain and motivate our employees, directors and consultants through the grant of stock options, stock appreciation rights, restricted stock, restricted stock units and other equity-based or equity-related awards. We believe the 2021 Plan is best designed to provide the proper incentives for our employees, directors and consultants, ensures our ability to make performance-based awards, and meets the requirements of applicable law. There are currently 45 individuals that would be eligible to participate in the 2021 Plan, of which 9 are directors or executive officers, 26 are employees and 10 are consultants.

5

We manage our long-term stockholder dilution by limiting the number of equity incentive awards granted annually. Our Board of Directors monitors our annual stock award Burn Rate, Dilution and Overhang (each as defined below), among other factors, in its efforts to maximize stockholders’ value by granting what, in the Board of Directors’ judgment, are the appropriate number of equity incentive awards necessary to attract, reward, and retain employees, consultants and directors. The table below illustrates our Burn Rate, Dilution, and Overhang for the past two fiscal years with details of each calculation noted below the table.

| 2020 | 2019 | |||||||

| Burn Rate (1) | 12 | % | 12 | % | ||||

| Dilution (2) | 11 | % | 12 | % | ||||

| Overhang (3) | 6 | % | 6 | % | ||||

| (1) | Burn Rate is the number of shares subject to equity awards granted during a fiscal year/weighted average common shares outstanding for that fiscal year. |

| (2) | Dilution is (the number of shares subject to equity awards + the number of shares available for future awards at the end of a fiscal year)/(number of shares outstanding at the end of the fiscal year + number of share subject to equity awards + number of shares available for future awards). |

| (3) | Overhang is (the number of shares subject to equity awards at the end of a fiscal year)/(number of shares outstanding at the end of the fiscal year + number of shares subject to equity awards + number of shares available for future awards). |

Summary of the 2021 Stock Incentive Plan

The following is a summary of the principal features of the 2021 Plan. This summary does not purport to be a complete description of all of the provisions of the 2021 Plan and it is qualified in its entirety by reference to the full text of the 2021 Plan, a copy of which is attached to this information statement as Appendix B hereto.

Available Shares. An aggregate of 15,000,000 shares of the Company’s common stock may be issued under the 2021, subject to equitable adjustment in the event of future stock splits including the Reverse Stock Split, if consummated, and other capital changes, all of which may be issued in respect of Incentive Stock Options (or ISOs) that meet the requirements of Section 422 of the Code.

In applying the aggregate share limitation under the 2021 Plan, shares of common stock (i) subject to awards that are forfeited, cancelled, returned to the Company for failure to satisfy vesting requirements or otherwise forfeited, or terminated without payment being made thereunder and (ii) that are surrendered in payment or partial payment of the exercise price of an option or taxes required to be withheld with respect to the exercise of stock options or in payment with respect to any other form of award are not counted and, therefore, may be made subject to new awards under the 2021 Plan.

Non-Employee Director Compensation Limit

Administration. The 2021 Plan will be administered by the Compensation Committee of our Board (the “Compensation Committee”). The Compensation Committee has discretion to determine the individuals to whom awards may be granted under the 2021 Plan, the number of shares of common stock, units or other rights subject to each award, the type of award, the manner in which such awards will vest, and the other conditions applicable to awards. The Compensation Committee is authorized to interpret the 2021 Plan, to prescribe, amend and rescind any rules and regulations relating to the 2021 Plan and to make any other determinations necessary or desirable for the administration of the 2021 Plan. All interpretations, determinations and actions by the Compensation Committee are final, conclusive and binding on all parties.

Eligibility. Any employee, officer, director, consultant, advisor or other individual service provider of the Company or any of its subsidiaries, or any person who is determined by our Compensation Committee to be a prospective employee, officer, director, consultant, advisor or other individual service provider of the Company or any of its subsidiaries is eligible to participate in the 2021 Plan. As of March 8, 2021, the Company had approximately 26 full-time employees, including 5 executive officers, 5 non-employee directors, and 10 consultants, advisors and/or other individual service providers. As awards under the 2021 Plan are within the discretion of the Compensation Committee, we cannot determine how many individuals in each of the categories described above will receive awards.

Types of Awards. Under the 2021 Plan, the Compensation Committee may grant nonqualified stock options (or NSOs), incentive stock options (or ISOs), stock appreciation rights (or SARs), restricted stock, stock units, performance shares, performance units, other cash-based awards and other stock-based awards. The terms of each award will be set forth in a written agreement with the recipient.

Stock Options. The Compensation Committee will determine the exercise price and other terms for each option and whether the options will be NSOs or ISOs. The exercise price per share of each option will not be less than 100% of the fair market value of the Company’s common stock on the date of grant or, if there are no trades on such date, then the closing price of a share of our common stock on the most recent date preceding the date of grant on which shares of common stock were publicly traded (or 110% of the fair market value per share in the case of ISOs granted to a ten-percent or more shareholder). However, if permissible under law and the rules of the exchange on which the Company is listed, options to participants who are not residents of the U.S. may be granted at a price below fair market value on the date of grant. On March 5, 2021, the closing sale price of a share of our common stock on the OTC Markets was $0.36.

6

ISOs may be granted only to employees and are subject to certain other restrictions. To the extent an option intended to be an ISO does not qualify as an ISO, it will be treated as a nonqualified option.

A participant may exercise an option by written notice and payment of the exercise price in cash, or, as determined by the Compensation Committee, through delivery of previously owned shares, the withholding of shares deliverable upon exercise, a cashless exercise program implemented by the Compensation Committee in connection with the 2021 Plan, and/or such other method as approved by the Compensation Committee and set forth in an award agreement. The maximum term of any option granted under the 2021 Plan is ten years from the date of grant (five years in the case of an ISO granted to a ten-percent or more shareholder). The Compensation Committee may, in its discretion, permit a holder of an NSO to exercise the option before it has otherwise become exercisable, in which case the shares of the Company’s common stock issued to the recipient will be restricted stock having analogous vesting restrictions to the unvested NSO before exercise.

No option may be exercisable for more than ten years (five years in the case of an ISO granted to a ten-percent or more shareholder) from the date of grant. Options granted under the 2021 Plan will be exercisable at such time or times as the Compensation Committee prescribes at the time of grant. No employee may receive ISOs that first become exercisable in any calendar year in an amount exceeding $100,000.

Unless an award agreement provides otherwise, if a participant’s Service (as defined in the 2021 Plan) terminates (i) by reason of his or her death or Disability (as defined in the 2021 Plan), any option held by such participant may be exercised, to the extent otherwise exercisable, by the participant or his or her estate or personal representative, as applicable, at any time in accordance with its terms for up to one year after the date of such participant’s death or termination of Service, as applicable, (ii) for Cause (as defined in the 2021 Plan), any option held by such participant will be forfeited and cancelled as of the date of termination of Service and (iii) for any reason other than death, Disability or Cause, any option held by such participant may be exercised, to the extent otherwise exercisable, up until ninety (90) days following termination of Service.

Stock Appreciation Rights. The Compensation Committee may grant SARs independent of or in connection with an option. The Compensation Committee will determine the other terms applicable to SARs. The base price per share of each SAR will not be less than 100% of the closing price of a share of the Company’s common stock on the date of grant or, if there are no trades on such date, then the closing price of a share of the Company’s common stock on the most recent date preceding the date of grant on which shares of common stock were publicly traded. The maximum term of any SAR granted under the 2021 Plan will be ten years from the date of grant. Generally, each SAR will entitle a participant upon exercise to an amount equal to the excess of the fair market value on the exercise date of one share of our common stock over the base price, multiplied by the number of shares of common stock as to which the SAR is exercised. Payment may be made in shares of Company common stock, in cash, or partly in shares of Company common stock and partly in cash, all as determined by the Compensation Committee.

Restricted Stock and Stock Units. The Compensation Committee may award restricted common stock and/or stock units under the 2021 Plan. Restricted stock awards consist of shares of stock that are transferred to a participant subject to restrictions that may result in forfeiture if specified conditions are not satisfied. Stock units confer the right to receive shares of the Company’s common stock, cash, or a combination of shares and cash, at a future date upon or following the attainment of certain conditions specified by the Compensation Committee, subject to applicable tax withholding requirements. The Compensation Committee will determine the restrictions and conditions applicable to each award of restricted stock or stock units, which may include performance-based conditions. Unless the Compensation Committee determines otherwise at the time of grant, holders of restricted stock will have the right to vote the shares and receive all dividends and other distributions.

Performance Shares and Performance Units. The Compensation Committee may award performance shares and/or performance units under the 2021 Plan. Performance shares and performance units are awards, payable in shares of the Company’s common stock, cash or a combination thereof, which are earned during a specified time period subject to the attainment of performance goals, as established by the Compensation Committee. The Compensation Committee will determine the restrictions and conditions applicable to each award of performance shares and performance units.

Incentive Bonus Awards. The Compensation Committee may award incentive bonus awards payable in cash or shares of common stock, as set forth in an award agreement. Incentive bonus awards may be based upon the attainment of specified levels of Company or subsidiary performance. The amount of an incentive bonus award to be paid upon the attainment of each targeted level of performance will equal a percentage of a participant’s base salary for the fiscal year, a fixed dollar amount or such other formula, as determined by the Compensation Committee. The Compensation Committee will determine the terms and conditions applicable to each incentive bonus award.

Other Stock-Based and Cash-Based Awards. The Compensation Committee may award other types of stock-based or cash-based awards under the 2021 Plan, including the grant or offer for sale of unrestricted shares of the Company’s common stock, in such amounts and subject to such terms and conditions as the Compensation Committee determines.

7

Transferability. Awards granted under the 2021 Plan will not be transferable other than by will or by the laws of descent and distribution, except that the Compensation Committee may permit NSOs, share-settled SARs, restricted stock, performance share or share-settled other stock-based awards to be transferred to family members and/or for estate planning or charitable purposes.

Change in Control. The Compensation Committee may, at the time of the grant of an award, provide for the effect of a change in control (as defined in the 2021 Plan) on any award, including (i) accelerating or extending the time periods for exercising, vesting in, or realizing gain from any award, (ii) eliminating or modifying the performance or other conditions of an award, (iii) providing for the cash settlement of an award for an equivalent cash value, as determined by the Compensation Committee, or (iv) such other modification or adjustment to an award as the Compensation Committee deems appropriate to maintain and protect the rights and interests of participants upon or following a change in control. Unless otherwise provided by an award agreement, the Compensation Committee may, in its discretion and without the need for the consent of any recipient of an award, also take one or more of the following actions contingent upon the occurrence of a change in control: (a) cause any or all outstanding options and SARs to become immediately exercisable, in whole or in part; (b) cause any other awards to become non-forfeitable, in whole or in part; (c) cancel any option or SAR in exchange for a substitute option and/or SAR; (d) cancel any award of restricted stock, stock units, performance shares or performance units in exchange for a similar award of the capital stock of any successor corporation; (e) redeem any restricted stock for cash and/or other substitute consideration with a value equal to the fair market value of an unrestricted share of the Company’s common stock on the date of the change in control; or (f) terminate any award in exchange for an amount of cash and/or property equal to the amount, if any, that would have been attained upon the exercise of such award or realization of the participant’s rights as of the date of the occurrence of the Change in Control (the “Change in Control Consideration”); provided, however that if the Change in Control Consideration with respect to any option or SAR does not exceed the exercise price of such option or SAR, the Compensation Committee may cancel the option or SAR without payment of any consideration therefor. Any such Change in Control Consideration may be subject to any escrow, indemnification and similar obligations, contingencies and encumbrances applicable in connection with the change in control to holders of the Company’s common stock. Without limitation of the foregoing, if as of the date of the occurrence of the change in control the Compensation Committee determines that no amount would have been attained upon the realization of the participant’s rights, then such award may be terminated by the Company without payment. The Compensation Committee may cause the Change in Control Consideration to be subject to vesting conditions (whether or not the same as the vesting conditions applicable to the award prior to the change in control) and/or make such other modifications, adjustments or amendments to outstanding Awards or the 2021 Plan as the Compensation Committee deems necessary or appropriate.

Term; Amendment and Termination. The 2021 Plan will continue in effect until terminated by the Board; provided, however, that no Award will be granted under the Plan on or after the 10th anniversary of the date of the adoption of the Plan by the Board; and provided further, that Awards granted prior to such expiration date may extend beyond that date. The Board of Directors may suspend, terminate, or amend the 2021 Plan in any respect at any time, provided, however, that (i) no amendment, suspension or termination may materially impair the rights of a participant under any awards previously granted, without his or her consent, (ii) the Company shall obtain stockholder approval of any 2021 Plan amendment as required to comply with any applicable law, regulation or stock exchange rule and (iii) stockholder approval is required for any amendment to the 2021 Plan that (x) increases the number of shares of common stock available for issuance thereunder or (y) changes the persons or class of persons eligible to receive awards.

New Plan Benefits

As of the date of this information statement, we are unable to determine any grants of awards under the 2021 Plan that will be made.

Interests of Directors and Executive Officers

Our current directors and executive officers have substantial interests in the matters set forth in this proposal since equity awards may be granted to them under the 2021 Plan.

Material United States Federal Income Tax Consequences

The following is a brief description of the principal federal income tax consequences, as of the date of this information statement, associated with the grant of awards under the 2021 Plan. This summary is based on our understanding of present United States federal income tax law and regulations. The summary does not purport to be complete or applicable to every specific situation. Furthermore, the following discussion does not address foreign, state or local tax consequences.

Options

Grant. There is generally no United States federal income tax consequence to the participant solely by reason of the grant of incentive stock options or nonqualified stock options under the 2021 Plan, assuming the exercise price of the option is not less than the fair market value of the shares on the date of grant.

Exercise. The exercise of an incentive stock option is not a taxable event for regular federal income tax purposes if certain requirements are satisfied, including the requirement that the participant generally must exercise the incentive stock option no later than three months following the termination of the participant’s employment with us. However, such exercise may give rise to alternative minimum tax liability (see “Alternative Minimum Tax” below). Upon the exercise of a nonqualified stock option, the participant will generally recognize ordinary income in an amount equal to the excess of the fair market value of the shares at the time of exercise over the amount paid by the participant as the exercise price. The ordinary income recognized in connection with the exercise by a participant of a nonqualified stock option will be subject to both wage and employment tax withholding, and we generally will be entitled to a corresponding deduction.

8

The participant’s tax basis in the shares acquired pursuant to the exercise of an option will be the amount paid upon exercise plus, in the case of a nonqualified stock option, the amount of ordinary income, if any, recognized by the participant upon exercise thereof.

Qualifying Disposition. If a participant disposes of shares of our common stock acquired upon exercise of an incentive stock option in a taxable transaction, and such disposition occurs more than two years from the date on which the option was granted and more than one year after the date on which the shares were transferred to the participant pursuant to the exercise of the incentive stock option, the participant will realize long-term capital gain or loss equal to the difference between the amount realized upon such disposition and the participant’s adjusted basis in such shares (generally the option exercise price).

Disqualifying Disposition. If the participant disposes of shares of our common stock acquired upon the exercise of an incentive stock option (other than in certain tax free transactions) within two years from the date on which the incentive stock option was granted or within one year after the transfer of shares to the participant pursuant to the exercise of the incentive stock option, at the time of disposition the participant will generally recognize ordinary income equal to the lesser of: (i) the excess of each such share’s fair market value on the date of exercise over the exercise price paid by the participant or (ii) the participant’s actual gain. If the total amount realized on a taxable disposition (including return on capital and capital gain) exceeds the fair market value on the date of exercise of the shares of our common stock purchased by the participant under the option, the participant will recognize a capital gain in the amount of the excess. If the participant incurs a loss on the disposition (the total amount realized is less than the exercise price paid by the participant), the loss will be a capital loss.

Other Disposition. If a participant disposes of shares of our common stock acquired upon exercise of a nonqualified stock option in a taxable transaction, the participant will recognize capital gain or loss in an amount equal to the difference between the participant’s basis (as discussed above) in the shares sold and the total amount realized upon disposition. Any such capital gain or loss (and any capital gain or loss recognized on a disqualifying disposition of shares of our common stock acquired upon exercise of incentive stock options as discussed above) will be short-term or long-term depending on whether the shares of our common stock were held for more than one year from the date such shares were transferred to the participant.

Alternative Minimum Tax. Alternative minimum tax is payable if and to the extent the amount thereof exceeds the amount of the taxpayer’s regular tax liability, and any alternative minimum tax paid generally may be credited against future regular tax liability (but not future alternative minimum tax liability).

Alternative minimum tax applies to alternative minimum taxable income. Generally, regular taxable income as adjusted for tax preferences and other items is treated differently under the alternative minimum tax.

For alternative minimum tax purposes, the spread upon exercise of an incentive stock option (but not a nonqualified stock option) will be included in alternative minimum taxable income, and the taxpayer will receive a tax basis equal to the fair market value of the shares of our common stock at such time for subsequent alternative minimum tax purposes. However, if the participant disposes of the incentive stock option shares in the year of exercise, the alternative minimum tax income cannot exceed the gain recognized for regular tax purposes, provided that the disposition meets certain third party requirements for limiting the gain on a disqualifying disposition. If there is a disqualifying disposition in a year other than the year of exercise, the income on the disqualifying disposition is not considered alternative minimum taxable income.

There are no federal income tax consequences to us by reason of the grant of incentive stock options or nonqualified stock options or the exercise of an incentive stock option (other than disqualifying dispositions). At the time the participant recognizes ordinary income from the exercise of a nonqualified stock option, we will be entitled to a federal income tax deduction in the amount of the ordinary income so recognized (as described above), provided that we satisfy our reporting obligations described below. To the extent the participant recognizes ordinary income by reason of a disqualifying disposition of the stock acquired upon exercise of an incentive stock option, and subject to the requirement of reasonableness, the provisions of Section 162(m) of the Code and the satisfaction of a tax reporting obligation, we generally will be entitled to a corresponding deduction in the year in which the disposition occurs. We are required to report to the Internal Revenue Service any ordinary income recognized by any participant by reason of the exercise of a nonqualified stock option. We are required to withhold income and employment taxes (and pay the employer’s share of the employment taxes) with respect to ordinary income recognized by the participant upon exercise of nonqualified stock options.

Stock Appreciation Rights

There are generally no tax consequences to the participant or us by reason of the grant of stock appreciation rights. In general, upon exercise of a stock appreciation rights award, the participant will recognize taxable ordinary income equal to the excess of the stock’s fair market value on the date of exercise over the stock appreciation rights’ base price, or the amount payable. Generally, with respect to employees, the Company is required to withhold from regular wages or supplemental wage payments an amount based on the ordinary income recognized. Subject to the requirement of reasonableness, the provisions of Section 162(m) of the Code and the satisfaction of a tax reporting obligation, the Company generally will be entitled to a business expense deduction equal to the taxable ordinary income realized by the participant.

9

Restricted Stock

Unless a participant makes a Section 83(b) election, as described below, with respect to restricted stock granted under the 2021 Plan, a participant receiving such an award will not recognize U.S. taxable ordinary income until an award is vested and we will not be allowed a deduction at the time such award is granted. While an award remains unvested or otherwise subject to a substantial risk of forfeiture, a participant will recognize compensation income equal to the amount of any dividends received and we will be allowed a deduction in a like amount. When an award vests or otherwise ceases to be subject to a substantial risk of forfeiture, the excess of the fair market value of the award on the date of vesting or the cessation of the substantial risk of forfeiture over the amount paid, if any, by the participant for the award will be ordinary income to the participant and will be claimed as a deduction for federal income tax purposes by us. Upon disposition of the shares received, the gain or loss recognized by the participant will be treated as capital gain or loss, and the capital gain or loss will be short-term or long-term depending upon whether the participant held the shares for more than one year following the vesting or cessation of the substantial risk of forfeiture.

However, by filing a Section 83(b) election with the Internal Revenue Service within 30 days after the date of grant, a participant’s ordinary income and commencement of holding period and the deduction will be determined as of the date of grant. In such a case, the amount of ordinary income recognized by such a participant and deductible by us will be equal to the excess of the fair market value of the award as of the date of grant over the amount paid, if any, by the participant for the award. If such election is made and a participant thereafter forfeits his or her award, no refund or deduction will be allowed for the amount previously included in such participant’s income.

Generally, with respect to employees, we are required to withhold from regular wages or supplemental wage payments an amount based on the ordinary income recognized. Subject to the requirement of reasonableness, the provisions of Section 162(m) of the Code the satisfaction of a tax reporting obligation and any tax withholding condition, we generally will be entitled to a business expense deduction equal to the taxable ordinary income realized by the recipient. Upon disposition of stock, the recipient will recognize a capital gain or loss equal to the difference between the selling price and the sum of the amount paid for such stock, if any, plus any amount recognized as ordinary income upon acquisition (or vesting) of the stock. Such gain or loss will be long- or short-term depending on whether the stock was held for more than one year from the date ordinary income is measured.

Section 409A

If an award under the 2021 Plan is subject to Section 409A of the Code, but does not comply with the requirements of Section 409A of the Code, the taxable events as described above could apply earlier than described, and could result in the imposition of additional taxes and penalties. Participants are urged to consult with their tax advisors regarding the applicability of Section 409A of the Code to their awards.

Potential Limitation on Company Deductions

Section 162(m) of the Code generally disallows a tax deduction for compensation in excess of $1 million paid in a taxable year by a publicly held corporation to its chief executive officer and certain other “covered employees”. Our board of directors and Compensation Committee intend to consider the potential impact of Section 162(m) on grants made under the 2021 Plan, but reserve the right to approve grants of options and other awards for an executive officer that exceeds the deduction limit of Section 162(m).

EQUITY COMPENSATION PLAN INFORMATION

Securities Authorized for Issuance Under Equity Compensation Plans

As of December 31, 2020, we had the following awards outstanding under our 2010 Plan:

| Number of securities to be issued upon exercise of outstanding options and warrants |

Weighted-average exercise price of outstanding options, warrants and rights |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a) |

||||||||||

| Plan Category | (a) | (b) | (c) | |||||||||

| Equity compensation plans approved by security holders | 8,305,985 | (1) | $ | 0.17 | 1,694,015 | |||||||

| Equity compensation plans not approved by stockholders | N/A | N/A | - | |||||||||

| Total | 8,305,985 | $ | 0.17 | 1,694,015 | ||||||||

| (1) | During the year ended December 31, 2020, we had awards outstanding under two incentive plans, the 2008 Plan and the 2010 Plan. As of the end of fiscal year 2020, we had no awards outstanding under the 2008 Plan and 8,305,985 shares of our common stock issuable upon the exercise of outstanding options granted pursuant to the 2010 Plan. The securities available under the Plan for issuance and issuable pursuant to exercises of outstanding options may be adjusted in the event of a change in outstanding stock by reason of stock dividend, stock splits, reverse stock splits, etc. As of end of fiscal year 2020, there were warrants outstanding to purchase 133,334 shares of common stock at a weighted average exercise price of $0.001, none of which were granted pursuant to the 2008 Plan or the 2010 Plan. |

10

EXECUTIVE COMPENSATION

Compensation of Executive Officers

The following summary compensation table sets forth all compensation awarded to, earned by, or paid to the named executive officers paid by the Company during the fiscal year ended December 31, 2020, in all capacities for the accounts of our executive officers, including the Chief Executive Officer.

Summary Compensation Table

| Name & Principal Position | Year | Salary | Bonus | Stock Awards |

Option Awards |

Non-Equity Incentive Plan Compensation |

All Other Compensation |

Total | ||||||||||||||||||||||||

| Charles M. Piluso, Chief Executive Officer, Chief Financial Officer, Treasurer and Chairman of the Board | 2020 | $ | 100,000 | — | — | $ | — | — | — | $ | 100,000 | |||||||||||||||||||||

| Harold Schwartz - President | 2020 | $ | 100,000 | — | — | $ | — | — | — | $ | 100,000 | |||||||||||||||||||||

| Tom Kempster – President of Operations | 2020 | $ | 129,585 | — | — | $ | — | — | — | $ | 129,585 | |||||||||||||||||||||

Employment Agreements

The Company does not have any employment agreements with any executive officers.

Outstanding Equity Awards at Fiscal Year-End December 31, 2020

| Option Awards | ||||||||||

| Name | Option Approval Date |

Number of Securities Underlying Unexercised Options (#) Exercisable(1) |

Unexercisable |

Option Exercise Price ($) |

Option Expiration Date |

|||||

| Charles M. Piluso | ||||||||||

| (1) | 6/18/2012 | 548,780 | 0 | 0.394 | 6/17/2022 | |||||

| (1) | 6/18/2012 | 357,143 | 0 | 0.394 | 6/17/2022 | |||||

| (2)(4) | 12/11/2012 | 33,333 | 0 | 0.150 | 12/10/2022 | |||||

| (2)(5) | 12/13/2013 | 33,333 | 0 | 0.150 | 12/12/2023 | |||||

| (2)(5) | 12/22/2015 | 66,666 | 0 | 0.350 | 12/21/2025 | |||||

| (2)(5) | 12/14/2017 | 66,666 | 0 | 0.050 | 12/14/2027 | |||||

| (2)(5) | 12/11/2019 | 33,333 | 66,667 | 0.060 | 12/10/2023 | |||||

| Harold J. Schwartz | ||||||||||

| (3)(5) | 6/18/2012 | 2,538 | 0 | 0.394 | 6/17/2022 | |||||

| (3)(4) | 12/11/2012 | 16,666 | 0 | 0.150 | 12/10/2022 | |||||

| (3)(5) | 12/13/2013 | 16,666 | 0 | 0.150 | 12/12/2023 | |||||

| (2)(5) | 12/22/2015 | 33,333 | 0 | 0.350 | 12/21/2025 | |||||

| (2)(5) | 12/14/2017 | 66,666 | 0 | 0.050 | 12/13/2027 | |||||

| (2)(5) | 12/11/2019 | 33,333 | 66,667 | 0.060 | 12/10/2023 | |||||

| Thomas C. Kempster | ||||||||||

| (2)(5) | 12/14/2017 | 66,666 | 0 | |||||||

| (2)(5) | 12/11/2019 | 33,333 | 66,667 | |||||||

| (1) | On March 23, 2011 (the “Stock Grant Date”), Mr. Piluso was issued a stock grant of 571,429 shares of common stock at $0.35 per share (the “Stock Grant”). Mr. Piluso received the Stock Grant in lieu of his annual compensation for 2010. The Stock Grant was fully vested on the Stock Grant Date. The Stock Grant was issued to Mr. Piluso pursuant to the 2008 Plan. On June 18, 2012, the Stock Grant issuance was rescinded and replaced with a stock option to acquire 548,780 shares of common stock at an exercise price of $0.39 per share. |

11

| (2) | The stock options were issued in consideration for services provided as a member of the Board. |

| (3) |

The stock options were issued in consideration for services provided as a member of the Board of Advisors.

|

| (4) | These option awards vested 100% three months from the grant date. |

| (5) | These option awards vested/vest 33.33% on each of the one- year, two- year and three- year anniversary following the grant date. |

Compensation of Directors

The following summary compensation table sets forth all compensation awarded to, earned by, or paid to the Company’s directors paid by the Company during the fiscal year ended December 31, 2020. During the year ended December 31, 2020, no compensation was paid to any Company director.

| Director Name | Fees earned or paid in cash | Stock awards | Option awards (1)(2) | Non-equity incentive plan |

Non-qualified deferred compensation earnings |

All other compensation | Total | |||||||||||||||||||||

| Charles M. Piluso (3) | — | — | $ | 0 | — | — | — | $ | 0 | |||||||||||||||||||

| Harold Schwartz (4) | — | — | $ | 0 | — | — | — | $ | 0 | |||||||||||||||||||

| Tom Kempster (5) | — | — | $ | 0 | — | — | — | $ | 0 | |||||||||||||||||||

| Lawrence Maglione (6) | — | — | $ | 0 | — | — | — | $ | 0 | |||||||||||||||||||

| John F. Coghlan (7) | — | — | $ | 0 | — | — | — | $ | 0 | |||||||||||||||||||

| John Argen (8) | — | — | $ | 0 | — | — | — | $ | 0 | |||||||||||||||||||

| Joseph B. Hoffman (9) | — | — | $ | 0 | — | — | — | $ | 0 | |||||||||||||||||||

| Clifford Stein (10) | — | — | $ | 0 | — | — | — | $ | 0 | |||||||||||||||||||

| Matthew Grover (11) | — | — | $ | 0 | — | — | — | $ | 0 | |||||||||||||||||||

| Todd Correll (12) | — | — | $ | 0 | — | — | — | $ | 0 | |||||||||||||||||||

| (1) | The stock options were issued in consideration for services provided as a member of the Board. |

| (2) | The amounts shown in these columns represent the aggregate grant date fair value of common stock and option awards computed in accordance with FASB ASC Topic 718. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Share Based Compensation” on page 14 for a discussion of the assumptions made in the valuation of stock and option awards. |

(3) The table below shows the aggregate number of option awards outstanding at fiscal year-end for each of our current non-employee directors and former non-employee directors who served as directors during the year ended December 31, 2020.

| Name |

Number of Shares Subject to Outstanding Options as of December 31, |

|||

| John Argen | 299,998 | |||

| John Coghlan | 333,498 | |||

| Todd Correll | 25,000 | |||

| Matthew Grover | 25,000 | |||

| Joseph Hoffman | 299,998 | |||

| Lawrence Maglione | 299,998 | |||

| Clifford Stein | 299,998 | |||

12

RATIFICATION AND APPROVAL OF THE CERTIFICATE OF CORRECTION AND CERTIFICATE OF VALIDATION TO THE CERTIFICATE OF AMENDMENT TO THE ARTICLES OF INCORPORATION FILED ON OCTOBER 7, 2008

On October 7, 2008, the Company filed an amendment to its Articles of Incorporation with the Secretary of State of the State of Nevada that was intended to increase the number of its authorized shares of common stock from 75,000,000 shares to 250,000,000 shares (the “October 7th Amendment”). Subsequent to filing the October 7th Amendment it was brought to the Company’s attention that the October 7th Amendment was improperly drafted to accomplish the intended purpose. Although the amendment referred to 250,000,000 authorized shares, the October 7th Amendment restated a copy of a corporate resolution adopted by the Company’s Board of Directors authorizing the filing of an amendment to the Articles of Incorporation to increase the authorized number of shares instead of actually providing the increase in the number of shares of common stock.

Because the October 7th Amendment may have been defective, the Board of Directors determined it would be in the best interest of the Company to take immediate corrective action and, pursuant to the action of the Board of Directors at a meeting held on March 8, 2021, the Board of Directors authorized and approved the Certificate of Correction and Certificate of Validation to the October 7th Amendment and directed that the Certificate of Correction and Certificate of Validation to the October 7th Amendment be submitted to the Company’s shareholders for ratification and approval and that the Company file the Certificate of Correction and Certificate of Validation to the October 7th Amendment. Consequently, the Consenting Stockholders ratified and approved the filing of a Certificate of Correction and Certificate of Validation to the October 7th Amendment pursuant to NRS 78.0295 and NRS 78.0296 to properly increase its authorized common shares to 250,000,000. NRS 78.0296 allows for the ratification or validation of noncompliant corporate acts if certain procedures are followed. We will file a Certificate of Correction and Certificate of Validation with respect to the October 7th Amendment with the Secretary of State of the State of Nevada, after the expiration of the twenty (20) day waiting period pursuant to Rule 14c-2 under the Exchange Act. Upon the filing of the Certificate of Correction and Certificate of Validation to the October 7th Amendment, the October 7th Amendment and any resulting putative stock issuances will no longer be deemed noncompliant acts and the effect of the ratification will be retroactive to the time of the original filing of the October 7th Amendment.

RATIFICATION AND APPROVAL OF THE CERTIFICATE OF CORRECTION AND CERTIFICATE OF VALIDATION TO THE CERTIFICATE OF AMENDMENT TO THE ARTICLES OF INCORPORATION FILED ON OCTOBER 16, 2008

On October 16, 2008, the Company filed an additional amendment to its Articles of Incorporation with the Secretary of State of the State of Nevada that was intended to increase the number of its authorized shares of capital stock from 250,000,000 shares to 260,000,000 shares, of which 250,000,000 shares were to be designated as common stock, par value $0.001 per share and 10,000,000 were to be designated blank check preferred stock, par value $0.001 (the “October 16th Amendment”). Subsequent to filing the October 16th Amendment, it was brought to the Company’s attention that the October 16th Amendment was improperly drafted to accomplish the intended purpose. Although the October 16th Amendment referred to blank check preferred stock it did not specify that the preferred stock could be issued from time to time in one or more series pursuant to a resolution or resolutions providing for such issue duly adopted by the Board of Directors (authority to do so being hereby expressly vested in the Board of Directors) and that the Board of Directors is further authorized, subject to limitations prescribed by law, to fix by resolution or resolutions the designations, powers, preferences and relative, participating, optional or other special rights, and the qualifications, limitations or restrictions thereof, of any wholly unissued series of Preferred Stock, including, without limitation, authority to fix by resolution or resolutions the dividend rights, dividend rate, conversion rights, voting rights, rights and terms of redemption (including sinking fund provisions), redemption price or prices, and liquidation preferences of any such series, and the number of shares constituting any such series and the designation thereof, or any of the foregoing. In addition, the October 16th Amendment restated a copy of a corporate resolution adopted by the Board of Directors authorizing the filing of an amendment to the Articles of Incorporation to increase the authorized number of shares instead of actually authorizing the increase in the number of shares of common stock and the creation of blank check preferred stock.

Because the October 16th Amendment may have been defective, the Board of Directors determined it would be in the best interest of the Company to take immediate corrective action and, pursuant to the action of the Board of Directors at a meeting held on March 8 2021, the Board of Directors authorized and approved the Certificate of Correction and Certificate of Validation to the October 16th Amendment and directed that the Certificate of Correction and Certificate of Validation to the October 16th Amendment be submitted to the Company’s shareholders for ratification and approval and that the Company file the Certificate of Correction and Certificate of Validation to the October 16th Amendment. Consequently, the Consenting Stockholders ratified and approved the filing of a Certificate of Correction and a Certificate of Validation to the October 16th Amendment pursuant to NRS 78.0295 and NRS 78.0296 to properly increase the Company’s authorized capital stock to 260,000,000 shares, of which 250,000,000 are designated as common stock, par value $0.001 per share, and 10,000,000 shares are designated as preferred stock, par value $0.001 per share, and to specify that the Board of Directors is further authorized, subject to limitations prescribed by law, to fix by resolution or resolutions the designations, powers, preferences and relative, participating, optional or other special rights, and the qualifications, limitations or restrictions thereof, of any wholly unissued series of preferred stock, including, without limitation, authority to fix by resolution or resolutions the dividend rights, dividend rate, conversion rights, voting rights, rights and terms of redemption (including sinking fund provisions), redemption price or prices, and liquidation preferences of any such series, and the number of shares constituting any such series of preferred stock and the designation thereof. NRS 78.0296 allows for the ratification or validation of noncompliant corporate acts if certain procedures are followed. We will file a Certificate of Correction and Certificate of Validation with respect to the October 16th Amendment with the Secretary of State of the State of Nevada, after the expiration of the twenty (20) day waiting period pursuant to Rule 14c-2 under the Exchange Act. Upon the filing of the Certificate of Correction and Certificate of Validation to the October 16th Amendment, the October 16th Amendment and any resulting putative stock issuances will no longer be deemed noncompliant acts and the effect of the ratification will be retroactive to the time of the original filing of the October 16th Amendment.

13

RATIFICATION AND APPROVAL OF THE CERTIFICATE OF CORRECTION AND CERTIFICATE OF VALIDATION TO THE CERTIFICATE OF AMENDMENT TO THE ARTICLES OF INCORPORATION FILED ON JANUARY 6, 2009

On January 6, 2009, the Company filed a Certificate of Amendment to its Articles of Incorporation to change the name of the Company from Euro Trend Inc. to Data Storage Corporation (the “January 6th Amendment”). Subsequent to filing the January 6th Amendment it was brought to the Company’s attention that the January 6th Amendment was improperly drafted to accomplish the intended purpose. Although the amendment referred to a corporate name change it restated a copy of a corporate resolution adopted by the Company’s board of directors authorizing the filing of an amendment to the Articles of Incorporation to change the Company’s name.