8-K/A: Current report filing

Published on June 29, 2009

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K8 /A

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date of

report (Date of earliest event reported): October 20,

2008

EURO

TREND INC.

(Exact

name of registrant as specified in Charter)

|

Nevada

|

98-0530147

|

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(Commission

File No.)

|

(IRS

Employee Identification No.)

|

875

Merrick Avenue

Westbury, NY

11590

(Address

of Principal Executive Offices)

(212)

564-4922

(Issuer

Telephone number)

13 Falcon

Hill

Lovers

Walk Tivoli, Cork, L2 0000Ireland

00-353-862-44-5850

(Former

name, former address and former fiscal year,

if

changed since last report)

Copies of

communications to:

RICHARD

I. ANSLOW, ESQ.

ANSLOW

& JACLIN, LLP

195

Route 9 South, Suite 204

Manalapan,

NJ 07726

TELEPHONE

NO.: (732) 409-1212

FACSIMILE

NO.: (732) 577-1188

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

|

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

|

|

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

|

|

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

|

Explanatory Note: This

Amendment No.1 on Form 8-K/A to the Euro Trend, Inc. Form 8-K originally filed

with the Securities and Exchange Commission on October 24, 2009 (the “Form 8-K”)

amends and restates the share issuance amount to the Data Storage Corporation

shareholders upon completion of the share exchange agreement and amends the

previously filed share exchange agreement as an exhibit to the Form

8-K.

Item 1.01 Entry Into A Material Definitive

Agreement

As more

fully described in Item 2.01 below, we acquired Data Storage Corporation

(“Data Storage” or “DSC”) a data storage company that specializes in data

protection, data archival and disaster recovery in accordance with a Share

Exchange Agreement dated October 20, 2008 (“Exchange Agreement”) by and among

Euro Trend Inc., a Nevada corporation (“Euro Trend” or the Company), Data

Storage Corporation, a Delaware corporation, and the Shareholders of Data

Storage. The closing of the transaction took place on October 20,

2008 (the “Closing Date”). On the Closing Date, pursuant to the

terms of the Exchange Agreement, we acquired all of the outstanding capital

stock and ownership interests of Data Storage (the “Interests”) from the Data

Storage Shareholders; and the Data Storage Shareholders transferred and

contributed all of their interests to us. In exchange, we issued to the Data

Storage Shareholders 83,687,500 shares of our common stock (the “Data Storage

Shares”) and 1,401,786 shares a Series A Preferred Stock. Pursuant to

the terms of the Exchange Agreement, Peter O’Brien cancelled a total of

3,000,000 shares of Euro Trend common stock.

Data

Storage is principally engaged in the sale of solutions that provide businesses

protection of critical electronic data, these services consist of data backup,

data replication, corporate compliance of data handling, while

insuring disaster recovery and business continuity.

Pursuant

to the Exchange Agreement, Data Storage became a wholly-owned subsidiary of Euro

Trend. A copy of the Exchange Agreement is included as Exhibit 2.1 to

this Current Report and is hereby incorporated by reference. All references to

the Exchange Agreement and other exhibits to this Current Report are qualified,

in their entirety, by the text of such exhibits.

This

transaction is discussed more fully in Section 2.01 of this Current Report. The

information therein is hereby incorporated in this Section 1.01 by

reference.

Item 2.01 Completion of Acquisition or

Disposition of Assets

On the

Closing Date, pursuant to the terms of the Exchange Agreement, we acquired all

of the outstanding capital stock and ownership interests of Data Storage from

the Data Storage Shareholders; and the Data Storage Shareholders transferred and

contributed all of their Interests to us. In exchange, we issued to

the Data Storage Shareholders 83,687,500 shares of our common stock, or

approximately 96% of our issued and outstanding common stock and 1,401,786

shares a Series A Preferred Stock. On the Closing Date, Data Storage

became our wholly owned subsidiary.

The above

transaction has been accounted for as a reverse merger (recapitalization) with

Data Storage being deemed the accounting acquirer and Euro Trend being deemed

the legal acquirer. Accordingly, all historical financial information presented

in all future filings of Euro Trend since October 20, 2008 (the date of the

reverse merger) will be that of Data Storage.

-1-

BUSINESS

Overview

Corporate

History

Euro

Trend Inc. was incorporated on March 27, 2007 under the laws of the State of

Nevada intending to commence business operations by distributing high-end

European made designer clothing in mass wholesale and retail markets throughout

Western Europe, Canada and the United States of America. On October 20, 2008 we

completed a Share Exchange Agreement whereby we acquired all of the outstanding

capital stock and ownership interests of Data Storage Corporation. In exchange

we issued 83,687,500 shares of our common stock and 1,401,786 shares a Series

A Preferred Stock to the Data Storage Shareholders.

Description

of Data Storage

Data

Storage Corporation (“Data Storage” or “DSC”) was incorporated in Delaware on

August 29, 2001. Data Storage develops and manages customized, powerful, premium

solutions for data protection including: Storage Infrastructure Design and

Management, Business Continuity Planning and Disaster Recovery, Virtualization,

Archiving, Disk and Transaction Mirroring, and Internet Services..

Data

Storage derives revenues from the sale of solutions that provide businesses

protection of critical electronic data. At this time, these services consist

primarily of offsite data backup and de-duplication for disaster recovery and

business continuity purposes. We have operations in a non-collocated datacenter

in Westbury, New York and a disaster recovery facility which is located over

1,000 miles away from the primary data center in Westbury, leveraging another

non-collocated facility in Fort Lauderdale, Florida. We deliver our services

over a highly intelligent, reliable, redundant and secure fiber optic network,

with separate and diverse routes to the Internet. This network and geographical

diversity is important to clients seeking storage hosting and backup services,

as it ensures protection of data in the case of a network

interruption.

Data

Storage is in the position today to leverage our infrastructure to grow revenue

to significant levels by asset acquisition of data backup service providers’

customer bases. The aim is to reduce costs through economies of scale while

reducing competition in local markets and consolidating efforts during the

current economic downturn. Over 4,000 such service providers exist today;

providing DSC with ample acquisition targets. Initial base acquisitions will be

derived from companies that offer similar services to Data Storage as greater

economies of scale can be realized using this strategy. In the future, DSC

believes opportunities exist to acquire synergistic service providers to enhance

our products and services portfolio. We believe that the opportunity exists

today to roll up customer bases from resellers and software licensees of backup

software. This will enable Data Storage to create a national presence as the

premiere encrypted data depository; the National Data Bank. The roll up of these

technical consulting companies and system integrators will also form a powerful

distribution channel for both our current and future product and service

offerings. Acquisition activity including organic growth is forecasted at $3.7

Million for 2009 and $9.7 Million for 2010. These revenue outlooks form the base

line revenue for each consecutive year since revenue is monthly recurring and

normally under a three year agreement with clients.

The

marketplace providing data backup services are segmented into systems

integrators that have added data protection services as an additionally product

line adding to their bundle of services and products. In many situations, these

companies have purchased equipment and software licenses, and in others, they

simply resell without equipment and invoice their clients on a monthly recurring

basis. Ownership of the account is with the software licensee or software

company. The companies that resell or whom have purchased equipment have a

restricted exit and little upside, except for their recurring compensation,

which ranges from 20% to 50%. These potential acquisitions sell into their

client base and convert their clients from an older technology to data vaulting.

Data Storage’s position will be to invite these potential acquisition candidates

to roll up, receiving cash and stock while providing their exit. These

acquisitions will become members of the national brand, National Data Bank; a

USA secured and encrypted data depositary which is currently in process of

registration. The companies whom have sold their bases to Data Storage will have

this identification on their business card and continue to receive a royalty and

continue to sell Data Storage services. This movement will unite the system

integrator and their client with Data Storage forming a powerful distribution

channel and one that does not exist today in the industry.

-2-

Today

there exists over 4,000 companies selling backup services, from small providers

selling backup to the local business to large companies offering the ability to

house their client’s employees and equipment in a situation of disaster, a hot

site.

As a

complete industry overview the combined disk, and optical storage industry is

approaching $50B in revenue, while the storage management software industry now

exceeds $5B in annual revenue. The global data storage market is forecasted to

reach $39B by year 2010. It already reached $19.8B by 2005. The enterprise

storage market is in excess of $15B, the midrange storage market in excess of

$13B, the storage software market is in excess of $9B and the network attached

storage in excess of $2B.

More

specially as it relates to the services planned and currently being provided,

IDC analysts’ worldwide storage-as-a-service forecast (in terms of backup,

archiving, and replication) shows demand for DSC’s core services increasing to

over $1.4 billion in 2011, up from under $400 million in 2006. IDC’s worldwide

online backup services forecast shows that demand for online backup services

specifically is growing year over year from 2006 through 2011 at a minimum of

25%. The largest growth is seen coming from the SMB, followed by enterprise

customers. Virtual Tape Library’s has a market size of 5 billion by

2012.

Data

Storage’s target base will be the mid size marketplace, initially, less than 500

employees; acquiring customer bases that range from 15 to 500 employee size

clients initially during 2008 and 2009. Average monthly client invoices ranges

per account will be 250 – 2500 dollars. Organically, Data Storage will continue

to focus on major distribution channels; the healthcare industry and the

continuation of channel partners and distributors.

It is our

objective to build a national data protection solution provider protecting

corporate and healthcare information while satisfying the business continuity

and compliance requirements.

Healthcare

DPS, a division of Data Storage, provides outsourced data protection technology

and services for hospitals, nursing and residential care facilities, physician’s

offices, home healthcare service companies, dental offices, alternative

healthcare offices, outpatient care centers, ambulatory healthcare service

companies, and medical and diagnostic laboratories in the New York metropolitan

area. Healthcare DPS assists companies in complying with HIPAA and other federal

and local regulations on data protection.

With zero

tolerance for downtime, larger healthcare organizations require extremely

reliable mission-critical data protection services. A host of state and industry

regulators are now urging, and in some cases requiring, the development of

business continuity and disaster recovery plans to ensure the backup, protection

and recovery of data on a long-term basis. Internet Services over Ethernet is

rapidly becoming the technology of choice to address these critical data center

needs, because of its ability to provide transparent connectivity over the wide

area. Data Storage offers an array of services in order to satisfy all of the

aforementioned requirements.

Description

of Data Storage’s Business

Data

Storage provides online backup, data archival and disaster recovery service for

a range of businesses, at a competitive cost through the operation of an

internet and private network based service utilizing state of the art technology

and high calibre personnel. Under our current management, we have grown and

developed adding personnel to provide services in all time zones.

-3-

We

service customers from our New York premises which consist of modern offices and

a technology suite adapted to meet the needs of a technology based business. Our

primary role is to provide, maintain and develop the network hub hardware and

software to meet the needs of our customers.

Data

Storage varies its use of resource, technology and work processes to meet the

changing opportunities and challenges presented by the market and the internal

customer requirements.

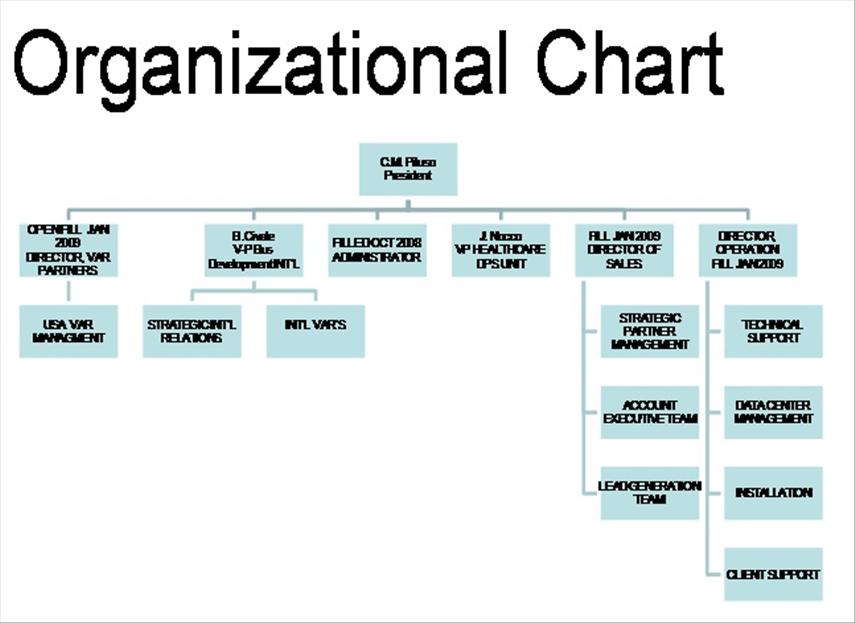

Organizational

Profile

-4-

Services

We offer

the following services to our clients.

Archiving-Backup Lifecycle

Management (BLM)

Backup

data must be managed throughout its life cycle to provide the best data

protection, meet compliance regulations and to improve recovery time objectives

(RTO). The BLM Archiver offers policy-based file archiving and manages archiving

and restoration of data from backup sessions, reducing the cost of inactive

files on-line. It creates restorable point-in-time copies of backup sets for

historical reference to meet compliance objectives and creates Certificates of

Destruction. All of an enterprise's data can be placed into one of two

categories. Critical information is that which is needed for day-to-day

operations and resides in the system's primary storage for fast access.

Important information is the historical, legal and regulatory information that

can safely be archived to secondary storage, lower cost disk or tapes stored

offsite.

Backup

Lifecycle Management is a growing trend that promises substantial savings in

hardware and administration, but not if the existing backup system is

BLM-unfriendly. To achieve the expected return on investment (ROI), most

enterprises will find it well worth choosing Distributed Backup that replaces

traditional tape backup and integrates with BLM's unique technology for the

greatest reduction in cost and complexity.

While

there are many backup solutions on the market, not all are BLM-ready, even among

those that backup to disk. It is important to note that simply replacing tape

with low-cost disk will not provide the technological advantages of a tested,

technologically distinct BLM architecture.

Continuous Data Protection

(CDP) Appliance

As data

continually mounts in today’s fast-paced business environment, organizations

need to protect their systems on an ongoing basis, or risk losing

mission-critical data, information, and transactions, as well as associated

business revenue.

Continuous

data protection is the process whereby data is captured and replicated to a

separate storage location to ensure that a set of critical data is always

available. With CDP you can roll back data to any known good point in time

whenever necessary. In the event of a planned (maintenance, upgrade) or

unplanned outage from a corrupted/lost file to a system failure or site level

disaster, CDP ensures rapid data recovery to minimize downtime and data

loss.

We

provide a scalable CDP solution architecture designed to maximize business

continuity of mission-critical messaging and database applications for data

centers, dispersed branch offices, and even individual desktops and

notebooks.

CDP

solutions employ sophisticated I/O, CPU, and network throttling to achieve

efficiency and reliability. Moreover, to protect against connectivity failures

and interruptions, CDP features an auto resume mechanism that sustains

replication and adapts according to the environment to achieve optimal and

predictable performance.

Hard Disk Recovery by

DriveSavers.com

We are an

authorized reseller of DriveSavers hard disk recovery. DriveSavers’ advanced

engineering methods and certified Class 100 clean room enable us to recover data

from all hard drives, storage devices and removable media. We can recover from

devices that have been dropped, sustained water or fire damage, suffered

corruption, power failure, file deletion, or reformatting.

-5-

DriveSavers

works with all versions of Windows, Mac, NetWare, and UNIX. They recover data

from hard drives and removable media such as floppy diskettes, CD, or DVD. They

also recover from all types of servers, RAID, SAN, and NAS devices.

Microsoft Exchange

Backup

Continuous

Data Protection (CDP) for Exchange

CDP

provides a more efficient e-mail backup option based on its virtually unlimited

granularity to remove the data loss vulnerabilities between regularly scheduled

backups by optimizing Recover Point Objectives (RPO). As e-mail messages enter

the Exchange server, CDP monitors the mailboxes and will immediately send those

new e-mails to be backed up. Customers can now restore data from an infinite

number of backup points, while the backup window and recovery time objectives

are effectively reduced to zero. CDP is enabled for Microsoft Exchange using the

Message Level Restore (MLR) functionality.

Offsite Backup

Services

We

provide online backup services that transfer a client’s information over the

Internet or on a dedicated private circuit to our secure company owned off-site

storage location. Our online backup service provides the most advanced data

protection solution for small and medium businesses. Our service turns an

ordinary server into a powerful and fully automated network backup

device.

Even the

most efficient organization must deal with the rare or occasional system

maintenance, failures and outages. However, all businesses with intensive

reliance on IT must be ready for the more catastrophic failures, such as fire,

power outage or natural disaster. Our system addresses all data protection

needs, from around-the-clock always updated protection of servers to the

compliant archiving of data.

Virtual Tape Library

(VTL)

Data

Storage VTL addresses the issues associated with using physical tape as a

primary backup/restore medium. Using a variety of protocols, VTL transfers data

to and from disk-based virtual tapes at ultra-high speeds for fast backup and

reliable recovery.

Replication

with VTL enables cost-effective electronic transport for data recovery and

infrastructure consolidation. Replication can be bi-directional, many-to-one, or

on-to-many, providing highly efficient protection for any topology.

Only

newly-created unique data is replicated, requiring a fraction of the bandwidth

utilized by other technologies. Physical tape can be eliminated from

remote/branch offices and consolidated at a central site. Only a single copy of

data is replicated, even if it exists at multiple sites.

Tape is

widely used as a prime medium for satisfying long-term compliance and archiving

requirements. VTL maximizes the functionality of physical tape by offering

multiple methods for creating and managing tapes, providing the flexibility to

meet any required tape management schema.

Organizations

today need to protect data company-wide, from the data center to the remote

office. VTL is scalable solution deployed in companies of all sizes, from small

and mid-sized businesses to large enterprise environments protecting multiple

Petabytes of data. Whether customers require the simplicity of a single VTL or

have multi-node and high-availability requirements, they can use VTL

confidently, knowing that the solution will scale as their business

grows.

-6-

Competition

Principal

competitors by service sector are:

Data

Protection

Commvault- a software

company focused primarily on data management. Uses singular architecture based

on Common Technology Engine to deliver data movement and expansion to changing

business requirements. Commvault offers a team of engineers and consultants for

customizing solutions for customers in six continents.

Fujitsu – With

regional sites in 70 countries, Fujitsu is a leading provider of IT based

business solutions. Along with Fujitsu Siemens Computers, it is one of the

world’s top providers of servers. Services include consulting systems,

integration, IT infrastructure management, computer products and

telecommunication.

Hitachi – is a

provider of servers, PCs, software, and telecommunications. The Information

& Telecommunication Systems segment is active in areas such as hardware,

communications infrastructure, hard disk drives and other storage products, as

well as the provision of systems integration services based on these

products.

Symantec – parent

company of Norton is an industry leader in electronic messaging security,

offering solutions for instant messaging, anti-spam, anti-virus, legal and

content compliance, legal discovery and message archiving.

CA (Computer

Associates) - offers data protection with a multi-layered solution that

combines data backup, security, replication and failover.

Data

De-Duplication

Diligent – is an

innovator in enterprise-class disk-based data protection solutions. Recently

acquired by IBM, it is the inventor of ProtecTIER, de-duplication platform

capable of inline de-duplication, eliminating redundant data and amount of

physical storage required.

NetApp – is a creator

of storage and data management solutions for maximizing cost efficiency,

offering single platform for a range of networked environments. Infrastructure

solutions include archive and compliance, business continuity, disk to disk

backup, storage consolidation and testing & development.

Overland Storage–

this company offers a complete set of data protection appliances for small and

midrange customers, to reduce backup window and simplify data retention.

Emphasis is on improving data recovery speed and cost effective methods of

disaster recovery.

Quantum – global

specialist in backup and recovery as well as archiving of data. It was the first

to market variable length de-duplication, virtual tape library for open systems

and unified disk to disk backup systems.

Virtual

Tape Library

Data Domain - is

aimed at reducing or eliminating tape infrastructure with disk and network based

data protection. Services include file storage, backup, disaster recovery, long

term retention of enterprise data and litigation support as well as regulatory

compliance assistance.

Falconstor –

implements solutions using Continuous Data Protector, virtual tape library and

network storage server. It offers a complete line of energy conscious

solutions for various industries using their IPstor storage virtualization

platform.

-7-

Sepaton

– is a provider of VTL solutions for data protection, offering

products and services to assist in a wide range of data protection issues such

as backup performance, regulatory/corporate compliance, disaster recovery and

containment of IT costs.

Off-Site

Data Vaulting

There are

many companies providing data vaulting services, from companies purchasing

wholesale without a data center or equipment and these that have invested in

equipment and software licensees. A smaller segment of companies have developed

software that provide for data vaulting some of which only license their

software and others that compete with their licensees.

Evault – offers

online backup and recovery solutions allowing automatic storage of critical data

and off-site vaults. It offers a broad range of services including archiving,

email compliance, eDiscovery, business continuity planning and disaster recovery

testing.

Sungard – is a leader

in software and processing technology for the financial services, higher

education and public sector industries. It is a major provider in information

availability solutions, managed IT as well as services for applications and data

center outsourcing.

Live

Vault / Iron Mountain - offers online backup and recovery solutions allowing

automatic storage of critical data and off-site vaults. It offers a broad range

of services including archiving, email compliance, eDiscovery.

Storage

Drives

IBM – (International

Business Machines Corporation) specializes in computer and technology consulting

as well as manufacturing and selling computer hardware and software.

Infrastructure services include hosting, from mainframe to

nanotechnology.

Employees

The

Company currently employs six employees and is expected to add four additional

employees by year end.

-8-

RISK

FACTORS

You should

carefully consider the risks described below together with all of the other

information included in this report before making an investment decision with

regard to our securities. The statements contained in or incorporated into this

current report that are not historic facts are forward-looking statements that

are subject to risks and uncertainties that could cause actual results to differ

materially from those set forth in or implied by forward-looking statements. If

any of the following risks actually occurs, our business, financial condition or

results of operations could be harmed. In that case, the trading price of our

common stock could decline, and you may lose all or part of your

investment.

Risks

Relating to Our Business

WE

DEPEND ON OUR KEY MANAGEMENT PERSONNEL AND THE LOSS OF THEIR SERVICES COULD

ADVERSELY AFFECT OUR BUSINESS.

We place

substantial reliance upon the efforts and abilities of our executive officers.

The loss of the services of any of our executive officers could have a material

adverse effect on our business, operations, revenues or prospects. We do not

currently have employment agreements with some of our officers. We do not

maintain key man life insurance on the lives of these individuals.

WE

NEED TO MANAGE GROWTH IN OPERATIONS TO MAXIMIZE OUR POTENTIAL GROWTH AND ACHIEVE

OUR EXPECTED REVENUES AND OUR FAILURE TO MANAGE GROWTH WILL CAUSE A DISRUPTION

OF OUR OPERATIONS RESULTING IN THE FAILURE TO GENERATE REVENUE.

In order

to maximize potential growth in our current and potential markets, we believe

that we must expand our marketing operations. This expansion will place a

significant strain on our management and our operational, accounting, and

information systems. We expect that we will need to continue to improve our

financial controls, operating procedures, and management information systems. We

will also need to effectively train, motivate, and manage our employees. Our

failure to manage our growth could disrupt our operations and ultimately prevent

us from generating the revenues we expect.

WE

MAY INCUR SIGNIFICANT COSTS TO ENSURE COMPLIANCE WITH U.S. CORPORATE GOVERNANCE

AND ACCOUNTING REQUIREMENTS.

We may

incur significant costs associated with our public company reporting

requirements, costs associated with applicable corporate governance

requirements, including requirements under the Sarbanes-Oxley Act of 2002 and

other rules implemented by the Securities and Exchange Commission. We expect all

of these applicable rules and regulations to significantly increase our legal

and financial compliance costs and to make some activities more time consuming

and costly. We also expect that these applicable rules and regulations may make

it more difficult and more expensive for us to obtain director and officer

liability insurance and we may be required to accept reduced policy limits and

coverage or incur substantially higher costs to obtain the same or similar

coverage. As a result, it may be more difficult for us to attract and retain

qualified individuals to serve on our board of directors or as executive

officers. We are currently evaluating and monitoring developments with respect

to these newly applicable rules, and we cannot predict or estimate the amount of

additional costs we may incur or the timing of such costs.

WE

MAY NEVER ISSUE DIVIDENDS.

We did

not declare any dividends for the year ended October 31, 2007 and have not

declared any dividends to date in 2008. Our board of directors does not intend

to distribute dividends in the near future. The declaration, payment and amount

of any future dividends will be made at the discretion of the board of

directors, and will depend upon, among other things, the results of our

operations, cash flows and financial condition, operating and capital

requirements, and other factors as the board of directors considers relevant.

There is no assurance that future dividends will be paid, and, if dividends are

paid, there is no assurance with respect to the amount of any such

dividend.

-9-

FUTURE

ACQUISITIONS MAY HAVE AN ADVERSE EFFECT ON OUR ABILITY TO MANAGE OUR

BUSINESS.

If we are

presented with appropriate opportunities, we may acquire complementary

technologies or companies. Future acquisitions would expose us to potential

risks, including risks associated with the assimilation of new technologies and

personnel, unforeseen or hidden liabilities, the diversion of management

attention and resources from our existing business and the inability to generate

sufficient revenues to offset the costs and expenses of acquisitions. Any

difficulties encountered in the acquisition and integration process may have an

adverse effect on our ability to manage our business.

Risks

Related to Our Industry

OUR

ABILITY TO CONTINUE TO DEVELOP AND EXPAND OUR PRODUCT OFFERINGS TO ADDRESS

EMERGING BUSINESS DEMANDS AND TECHNOLOGICAL TRENDS WILL IMPACT OUR FUTURE

GROWTH. IF WE ARE NOT SUCCESSFUL IN MEETING THESE BUSINESS CHALLENGES, OUR

RESULTS OF OPERATIONS AND CASH FLOWS WILL BE MATERIALLY AND ADVERSELY

AFFECTED.

Our

ability to implement solutions for our customers incorporating new developments

and improvements in technology which translate into productivity improvements

for our customers and to develop product offerings that meet the current and

prospective customers’ needs are critical to our success. The markets we serve

are highly competitive. Our competitors may develop solutions or services which

make our offerings obsolete. Our ability to develop and implement up to date

solutions utilizing new technologies which meet evolving customer needs in

backup and disaster recovery solutions will impact our future revenue growth and

earnings.

OUR

PRIMARY MARKET CONSISTING OF SMALL TO MEDIUM BUSINESSES WITH INFORMATION

TECHNOLOGY REQUIREMENTS THAT CAN BE SERVICED BY OUR PRODUCTS, IS A HIGHLY

COMPETITIVE MARKET. IF WE ARE UNABLE TO COMPETE IN THIS HIGHLY COMPETITIVE

MARKET, OUR RESULTS OF OPERATIONS WILL BE MATERIALLY AND ADVERSELY

AFFECTED.

Our

competitors include large, technically competent and well capitalized companies.

As a result, the markets which we serve are highly competitive. This competition

may place downward pressure on operating margins in our industry. As a result,

we may not be able to maintain our current operating margins for our product

offerings in the future.

Any

reductions in margins will require that we effectively manage our cost

structure. If we fail to effectively manage our cost structure during periods

with declining margins, our results of operations will be adversely

affected.

THE

BACKUP AND DISASTER RECOVERY SPACE IS HIGHLY COMPETITIVE AND FRAGMENTED, WHICH

MEANS THAT OUR CUSTOMERS HAVE A NUMBER OF CHOICES FOR PROVIDERS OF SERVICES AND

PRODUCTS AND WE MAY NOT BE ABLE TO COMPETE EFFECTIVELY.

The

market for our products is highly competitive. The market is fragmented, there

are a wide variety of product offerings with different capabilities, and no

company holds a dominant position. Consequently, our competition for clients

varies significantly Most of our competitors are larger and have greater

technical, financial, and marketing resources and greater name recognition than

we have in the markets we collectively serve. In addition, clients may elect to

increase their internal IT systems resources to satisfy their backup/disaster

recovery needs.

-10-

CHANGES

IN GOVERNMENT REGULATIONS AND LAWS AFFECTING THE IT INDUSTRY, INCLUDING

ACCOUNTING PRINCIPLES AND INTERPRETATIONS AND THE TAXATION OF DOMESTIC AND

FOREIGN OPERATIONS, COULD ADVERSELY AFFECT OUR RESULTS OF

OPERATIONS.

Changing

laws, regulations and standards relating to corporate governance and public

disclosure, including the Sarbanes-Oxley Act of 2002 and new SEC regulations,

are creating uncertainty for companies such as ours. These new or changed laws,

regulations and standards are subject to varying interpretations which, in many

instances, is due to their lack of specificity. As a result, the application of

these new standards and regulations in practice may evolve over time as new

guidance is provided by regulatory and governing bodies. This could result in

continuing uncertainty regarding compliance matters and higher costs

necessitated by ongoing revisions to disclosure and governance practices. We are

committed to maintaining high standards of corporate governance and public

disclosure. As a result, our efforts to comply with evolving laws, regulations

and standards have resulted in, and are likely to continue to result in,

increased general and administrative expenses and a diversion of management time

and attention from revenue-generating activities to compliance activities. In

particular, our efforts to comply with Section 404 of the Sarbanes-Oxley Act of

2002 and the related regulations regarding our required assessment of our

internal controls over financial reporting and our independent auditors’ audit

of that assessment has required the commitment of significant internal,

financial and managerial resources.

The

Financial Accounting Standards Board, SEC or other accounting rulemaking

authorities may issue new accounting rules or standards that are different than

those that we presently apply to our financial results. Such new accounting

rules or standards could require significant changes from the way we currently

report our financial condition, results of operations or cash

flows.

U.S.

generally accepted accounting principles have been the subject of frequent

interpretations. As a result of the enactment of the Sarbanes-Oxley Act of 2002

and the review of accounting policies by the SEC as well as by national and

international accounting standards bodies, the frequency of future accounting

policy changes may accelerate. Such future changes in financial accounting

standards may have a significant effect on our reported results of operations,

including results of transactions entered into before the effective date of the

changes.

We are

subject to income taxes in the United States. Our provision for income taxes and

our tax liability in the future could be adversely affected by numerous factors

including, but not limited to, changes in the valuation of deferred tax assets

and liabilities, and changes in tax laws, regulations, accounting principles or

interpretations thereof, which could adversely impact our financial condition,

results of operations and cash flows in future periods.

Risks

Associated with our Securities

We may be

subject now and in the future to the SEC’s “penny stock” rules if our shares of

common stock sell below $5.00 per share. Penny stocks generally are

equity securities with a price of less than $5.00. The penny stock

rules require broker-dealers to deliver a standardized risk disclosure document

prepared by the SEC which provides information about penny stocks and the nature

and level of risks in the penny stock market. The broker-dealer

must also provide the customer with current bid and offer

quotations for the penny stock, the compensation of the broker-dealer and its

salesperson, and monthly account statements showing the market

value of each penny stock held in the customer's account. The bid and offer

quotations, and the broker-dealer and salesperson compensation information must

be given to the customer orally or in writing prior to completing the

transaction and must be given to the customer in writing before or with the

customer's confirmation.

In

addition, the penny stock rules require that prior to a transaction, the broker

dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the

purchaser's written agreement to the transaction. The penny stock rules are burdensome and may reduce

purchases of any offerings and reduce the trading activity for shares of our

common stock. As long as our shares of common stock are

subject to the penny stock rules, the holders of such shares of common stock may

find it more difficult to sell their securities.

OUR

SHARES OF COMMON STOCK ARE VERY THINLY TRADED, AND THE PRICE MAY NOT REFLECT OUR

VALUE AND THERE CAN BE NO ASSURANCE THAT THERE WILL BE AN ACTIVE MARKET FOR OUR

SHARES OF COMMON STOCK EITHER NOW OR IN THE FUTURE.

Our

shares of common stock are very thinly traded, and the price if traded may not

reflect our value. There can be no assurance that there will be an active market

for our shares of common stock either now or in the future. The market liquidity

will be dependent on the perception of our operating business and any steps that

our management might take to bring us to the awareness of investors. There can

be no assurance given that there will be any awareness generated. Consequently,

investors may not be able to liquidate their investment or liquidate it at a

price that reflects the value of the business. If a more active market should

develop, the price may be highly volatile. Because there may be a low price for

our shares of common stock, many brokerage firms may not be willing to effect

transactions in the securities. Even if an investor finds a broker willing to

effect a transaction in the shares of our common stock, the combination of

brokerage commissions, transfer fees, taxes, if any, and any other selling costs

may exceed the selling price. Further, many lending institutions will not permit

the use of such shares of common stock as collateral for any loans.

-11-

MANAGEMENT'S

DISCUSSION AND ANALYSIS OR PLAN OF OPERATIONS

Forward-Looking

Statements

The

following discussion may contain certain forward-looking statements. Such

statements are not covered by the safe harbor provisions. These statements

include the plans and objectives of management for future growth of the Company,

including plans and objectives related to the consummation of acquisitions and

future private and public issuances of the Company's equity and debt securities.

The forward-looking statements included herein are based on current expectations

that involve numerous risks and uncertainties. Assumptions relating to the

foregoing involve judgments with respect to, among other things, future

economic, competitive and market conditions and future business decisions, all

of which are difficult or impossible to predict accurately and many of which are

beyond the control of the Company. Although the Company believes that the

assumptions underlying the forward-looking statements are reasonable, any of the

assumptions could be inaccurate and, therefore, there can be no assurance that

the forward-looking statements included in this report will prove to be

accurate. In light of the significant uncertainties inherent in the

forward-looking statements included herein, the inclusion of such information

should not be regarded as a representation by the Company or any other person

that the objectives and plans of the Company will be achieved.

The words

“we,” “us” and “our” refer to the Company. The words or phrases “would be,”

“will allow,” “intends to,” “will likely result,” “are expected to,” “will

continue,” “is anticipated,” “estimate,” “project,” or similar expressions are

intended to identify “forward-looking statements.” Actual results could differ

materially from those projected in the forward looking statements as a result of

a number of risks and uncertainties, including but not limited to: (a) limited

amount of resources devoted to achieving our business plan; (b) our failure to

implement our business plan within the time period we originally planned to

accomplish; (c) our strategies for dealing with negative cash flow; and (d)

other risks that are discussed in this report or included in our previous

filings with the Securities and Exchange Commission.

COMPANY

OVERVIEW

Data

Storage provides online backup, data archival and disaster recovery service to

businesses at a competitive cost through the operation of an internet and

private network based service utilizing state of the art technology and high

calibre personnel. Under our current management, we have grown and developed

adding personnel to provide a service in all time zones.

We

service customers from our New York premises which consist of modern offices and

a technology suite adapted to meet the needs of a technology based business. Our

primary role is to provide, maintain and develop the network hub hardware and

software to meet the needs of our customers.

Data

Storage varies its use of resource, technology and work processes to meet the

changing opportunities and challenges presented by the market and the internal

customer requirements.

PLAN

OF OPERATIONS

Data

Storage is in the position today to leverage our excellent infrastructure to

grow revenue to significant levels by asset acquisition of data backup service

providers’ customer bases. The aim is to reduce costs through economies of scale

while reducing competition in local markets and consolidating efforts during the

current economic downturn. Over 4,000 such service providers exist today;

providing us with ample acquisition targets. Initial base acquisitions will come

from companies that offer similar services to Data Storage as greater economies

of scale can be realized using this strategy. In the future, we see

opportunities to acquire synergistic service providers to enhance or products

and services portfolio. We believe that the opportunity exists today to roll up

customer bases from resellers and software licensees of backup software. This

will enable Data Storage to create a national presence as the premiere encrypted

data depository; the National Data Bank. The roll up of these technical

consulting companies and system integrators will also form a powerful

distribution channel for both our current and future product and service

offerings. Acquisition activity including organic growth is forecasted at $3.7

Million for 2009 and $9.7 Million for 2010.

-12-

The

marketplace providing data backup services are segmented into systems

integrators that have added data protection services as an additionally product

line adding to their bundle of services and products. In many situations, these

companies have purchased equipment and software licenses, and in others, they

simply resell without equipment and invoice their clients on a monthly recurring

basis. Ownership of the account is with the software license or software

company. The companies that resell or whom have purchased equipment have a

restricted exit and little upside, except for their recurring compensation,

which ranges from 20% to 50%. These potential acquisitions sell into their

client base and convert their clients from an older technology to data vaulting.

Data Storage’s position will be to invite these potential acquisition candidates

to roll up, receiving cash and stock while providing their exit. These

acquisitions will become members of the national brand, National Data Bank; a

USA secured and encrypted data depository. The companies whom have sold their

bases to Data Storage will have this identification on their business card and

continue to receive a royalty and continue to sell Data Storage services. This

movement will unite the system integrator and their client with Data Storage

forming a powerful distribution channel and one that does not exist today in the

industry.

Today

there exists over 4,000 companies selling backup services, from small providers

selling backup to the local business to large companies offering the ability to

house their client’s employees and equipment in a situation of disaster, a hot

site.

Today,

the products and services that Data Storage offers are the following: Data

Vaulting with a market size of 5 billion by 2013, Virtual Tape Library’s with a

market size of 5 billion by 2010; Data Replication; and, Professional Services

with Business Continuity Planning Services. Data Storage’s target base will be

the mid size marketplace, initially, less the 500 employees; acquiring customer

bases that range from 15 to 500 employee size clients initially during 2008 and

2009. Average revenue ranges per account will be $250 – $2,500 per month.

Organically, Data Storage will continue to focus on major distribution channels;

the healthcare industry and the continuation of channel partners and

distributors.

It is our

objective to build a national data protection solution provider protecting

corporate and healthcare information while satisfying the business continuity

and compliance requirements.

Through

Healthcare DPS, a division of Data Storage, we provide outsourced data

protection technology and services for hospitals, nursing and residential care

facilities, physician’s offices, home healthcare service companies, dental

offices, alternative healthcare offices, outpatient care centers, ambulatory

healthcare service companies, and medical and diagnostic laboratories in the New

York metropolitan area. Healthcare DPS assists companies in complying

with HIPAA and other federal and local regulations on data

protection.

With zero

tolerance for downtime, larger healthcare organizations require extremely

reliable mission-critical data protection services. A host of state and industry

regulators are now urging, and in some cases requiring, the development of

business continuity and disaster recovery plans to ensure the backup, protection

and recovery of data on a long-term basis. Internet Services over Ethernet is

rapidly becoming the technology of choice to address these critical data center

needs, because of its ability to provide transparent connectivity over the wide

area. Data Storage offers an array of services in order to satisfy all of the

aforementioned requirements.

-13-

Principal Factors Affecting our

Financial Performance

We

believe that the following factors affect our financial

performance:

|

·

|

Ability

to successfully negotiate asset acquisitions of other data storage

providers

|

|

·

|

Ability

to continue to sell services

|

|

·

|

Risk

of price compression in the

industry

|

Results

of Operations

DATA

STORAGE CORPORATION

STATEMENTS

OF OPERATIONS

YEARS

ENDED DECEMBER 31, 2007 AND 2006

|

2007

|

2006

|

|||||||

|

Sales

|

$ | 668,172 | $ | 418,347 | ||||

|

Cost

of sales

|

339,223 | 345,819 | ||||||

|

Gross

Profit

|

328,949 | 72,528 | ||||||

|

Selling,

general and administrative

|

574,130 | 456,891 | ||||||

|

Loss

from Operations

|

(245,181 | ) | (384,363 | ) | ||||

|

Other

Income:

|

||||||||

|

Interest

Income

|

674 | 543 | ||||||

|

Other

Income

|

- | 420 | ||||||

|

Total

Other Income

|

674 | 963 | ||||||

|

Loss

before provision for income taxes

|

(244,507 | ) | (383,400 | ) | ||||

|

Provision

for income taxes

|

- | - | ||||||

|

Net

Loss

|

$ | (244,507 | ) | $ | (383,400 | ) | ||

Net

Revenue

Net

Revenues increased $249,825 from $418,347 for the year ended December 31, 2006

to $668,172 for the year ended December 31, 2007 or 59.72%. This is

principally due to sales to new customers and growth coming from increased sales

to existing customers

-14-

Cost

of Goods Sold

Cost of

Goods sold decreased $6,596 from $345,819 for the year ended December 31, 2006

to $339,223 for the year ended December 31, 2007. This decrease is

primarily due to a restructuring of customer service employees.

Gross

profit percentage

Gross

profit percentage increased 31.9% from 17.3% for the year ended December 31,

2006 to 49.2% for the year ended December 31, 2007. This is due to

the fact that the data center operations did not require significant additional

expense to support the growth in customer base.

Selling General & Administrative

Selling

General & Administrative expenses increased by $117,239 from $456,891 for

the year ended December 31, 2006 to $574,130 for the year ended December 31,

2007. This was principally due to the addition of management salaries

of $79,231 and telemarketing salaries of $45,916

DATA

STORAGE CORPORATION

STATEMENTS

OF OPERATIONS

FOR

THE SIX MONTHS ENDED JUNE 30, 2008 AND 2007

|

2008

|

2007

|

|||||||

|

Sales

|

$ | 328,587 | $ | 337,917 | ||||

|

Cost

of sales

|

163,603 | 169,667 | ||||||

|

Gross

Profit

|

164,984 | 168,250 | ||||||

|

Selling,

general and administrative

|

286,644 | 280,191 | ||||||

|

Loss

from Operations

|

(121,660 | ) | (111,941 | ) | ||||

|

Other

Income (expense):

|

||||||||

|

Interest

Income

|

36 | 630 | ||||||

|

Interest

Expense

|

(876 | ) |

-

|

|||||

|

Total

Other Income (Expense)

|

(840 | ) | 630 | |||||

|

Loss

before provision for income taxes

|

(122,500 | ) | (111,311 | ) | ||||

|

Provision

for income taxes

|

- | - | ||||||

|

Net

Loss

|

$ | (122,500 | ) | $ | (111,311 | ) | ||

-15-

Net

Revenue

Net revenue declined by $9,330 from

$337,917 in the six months ended June 30, 2007 to $328,587 for the six months

ended June 30, 2008. This represented a decrease of

2.76%

Cost of

Goods Sold

Cost of

goods sold remained consistent at 50% for both periods presented

Selling

General & Administrative Expenses

Selling,

General & Administrative expenses increased $6,453 or 2.3% from $280,191 for

the six months ended June 30, 2007 to $286,644 for the six months ended June 30,

2008. This is principally due to general inflation increases in

costs.

LIQUIDITY

AND CAPITAL RESOURCES

The

Company currently generates its cash flow through operations which it believes

will be sufficient to sustain current level operations for at least the next

twelve months. In 2008 we intend to continue to work to increase our

presence in the marketplace through both organic growth and acquisition of data

storage service provider’s assets.

To the

extent we are successful in growing our business, identifying potential

acquisition targets and negotiating the terms of such acquisition, and the

purchase price includes a cash component, we plan to use our working capital and

the proceeds of any financing to finance such acquisition costs. Our opinion

concerning our liquidity is based on current information. If this information

proves to be inaccurate, or if circumstances change, we may not be able to meet

our liquidity needs.

During

the calendar year 2007 the company’s cash increased $14,177 to $37,803. The

Company’s principal shareholder funded the company’s capital needs for the year

ended December 31, 2007 on an as needed basis.

The

Company’s working capital increased $1.3 million from between July 1, 2008 and

October 15, 2008. This increase arose from the sale of preferred stock to 4

individuals who were not previously shareholders of the Company.

MANAGEMENT

Appointment

of New Directors

Effective

as of the closing of the exchange transaction, and subject to applicable

regulatory requirements, Mr. Peter O’ Brien our former President, Chief

Executive Officer, Chief Financial Officer, Principal Accounting Officer,

Treasurer, and Sole Director resigned from all positions held with the

Company.

The

following table sets forth the names, ages, and positions of our new executive

officers and directors as of the Closing Date. Executive officers are elected

annually by our Board of Directors. Each executive officer holds his office

until he resigns, is removed by the Board, or his successor is elected and

qualified. Directors are elected annually by our stockholders at the annual

meeting. Each director holds his office until his successor is elected and

qualified or his earlier resignation or removal.

-16-

|

NAME

|

AGE

|

POSITION

|

|

Charles

M. Piluso

|

55

|

President,

Chief Executive Officer, Chief Financial Officer, Principal Accounting

Officer, Chairman of the Board and Treasurer

|

|

Jason

Nocco

|

29

|

Secretary

|

|

Lawrence

A. Maglione

|

46

|

Director

|

|

Richard

P. Rebetti, Jr.

|

42

|

Director

|

|

John

Argen

|

54

|

Director

|

|

Joseph

B. Hoffman

|

51

|

Director

|

|

Jan

Burman

|

56

|

Director

|

|

Biagio

Civale

|

73

|

Director

|

Charles M. Piluso,

President, Chief Executive Officer, Chief Financial Officer, Principal

Accounting Officer, Chairman of the Board and Treasurer

Prior to

Data Storage Corporation, Mr. Piluso founded North American Telecommunication

Corporation; facilities based Competitive Local Exchange Carrier licensed by the

Public Service Commission in ten states, serving as the company's Chairman and

President from 1997 to 2000. Between 1990 and 1997, Mr. Piluso served as

Chairman & founder of International Telecommunications Corporation, a

facilities-based international carrier licensed by the Federal Communications

Commission.

Founded International Telecommunications Corporation in 1990 and grew from two employees to 135 employees with $170 million in revenues by 1997. The company had operations, agreements and partnerships in many countries including Russia, Ukraine, Jordan, Israel, United Kingdom, Dominican Republic, Chile and Canada. During his tenure, Mr. Piluso grew the company to the fifth largest international facilities based carrier in the USA within five years. In 1995 Mr. Piluso sold an interest to Ronald Lauder’s Venture Group and then finally cashed out in 1997 to a Latin America Group.

Mr.

Piluso's career in the telecommunications industry began in 1978 when he joined

ITT Corporation's Telephone Equipment Division. Over the years, Mr. Piluso was

promoted from Sales to Sales Management, Marketing and Business Development in

their Long Distance Division until 1984. He left ITT to become the General

Manager of the New York region for United Technologies Corporation’s telephone

unit.

Mr.

Piluso graduated from St. John's University in 1976 with a Bachelor's Degree,

received a Master's of Arts in Political Science and Public Administration, and

earned a Masters of Business Administration in May 1986. Mr. Piluso was an

Instructor Professor at St. John's University from 1986 through 1988 in the

College of Business. Member of the Board of Trustees: Molloy College;

Member of the Board of Governors: Saint John’s University; and, received the

2001 Outstanding Alumni Award: Saint John’s University.

Jason Nocco,

Secretary

Mr. Nocco

joined Data Storage Corporation in 2001 and was promoted to Secretary in 2008.

Mr. Nocco is responsible for Data Storage Corporation's Information Technology

including Data Center Management, Technical Support Group, Client Installation,

Channel Partner Support and Client Help Desk. Prior to Data Storage

Corporation, Mr. Nocco was employed by Cablevision Systems Corporation and The

Dime Bank. Mr. Nocco holds a Bachelors of Science in Computer Technology and

Networking from State University of New York and is also a graduate of the

Executive Master’s in Business Administration degree program at the Zicklin

School of Business at CUNY Baruch College.

-17-

Lawrence A. Maglione,

Director

Mr.

Maglione is a partner in the accounting firm Eisner & Maglione CPAs,

LLC. Mr. Maglione, a co-founder of Data Storage Corporation, is a

financial management veteran with more than 24 years of experience. Prior to

joining Data Storage Corporation Mr. Maglione was a co-founder of North American

Telecommunications Corporation, a local phone service provider which provides

local and long distance telephone services and data connectivity to small and

medium sized businesses.

At North

American Telecommunications Corporation Mr. Maglione was Chief Financial

Officer, Executive Vice President and was responsible for all finance, legal and

administration. During his tenor Mr. Maglione successfully raised over $100

million in debt and equity funding for North American Telecommunications

Corporation.

Prior to

North American Telecommunications Corporation Mr. Maglione spent over 14 years

in public accounting and he brings a broad range of experience related to

companies in the technology, retail services and manufacturing

industries.

Mr.

Maglione is a member of the American Institute of Certified Public Accountants

and the New York State Society of CPAs. He holds a Bachelor of Science degree in

Accounting; a Master’s of Science in Taxation and is a Certified Public

Accountant.

Richard P. Rebetti Jr.,

Director

Prior to

working for Data Storage Corporation, Mr. Rebetti was a co-founder of North

American Telecommunications Corporation, where he worked from September of 1997

through February of 2001. North American Telecom is a competitive local exchange

carrier offering local, long distance and data services to small and medium size

businesses.

Mr.

Rebetti was responsible for Systems and Technology, which included, Information

Systems, Internet services, service delivery and Operational Support Systems.

During the initial two years he was also responsible for billing, corporate

marketing and client care.

Prior to

working for North American Telecommunications Corporation, Mr. Rebetti worked

for RSL COM, U.S.A., Inc., formally International Telecommunications Corporation

(ITC). He was a co-founder of ITC in May of 1990. During his first 5 years at

ITC, he was responsible for setting up and managing the accounting, billing and

M.I.S. departments. During his last year and a half at RSL COM, U.S.A., Inc. he

was President of RSL Com PriceCall, Inc. RSL Com PriceCall was the enhanced

services division of RSL COM, U.S.A., Inc. During his tenure as President of

PrimeCall, annual revenue went from $4,000,000 in 1995 to $40,000,000 in

1997.

Mr.

Rebetti has a Bachelors of Science Degree in Finance and an Advanced

Professional Certificate in Accounting from St. John's University, New York, as

well as a Masters of Business Administration in Management from City University

of New York, Baruch College.

John Argen,

Director

John

Argen is a Business Consultant and Developer specializing in the information

technology, telecommunications and construction industries. He is a seasoned

professional that brings 30 years of experience and entrepreneurial success from

working with small business owners to Fortune 500 firms.

From 1992

to 2003, John Argen was the CEO and founder of DCC Systems, a privately held

nationwide Technology Design / Build Construction Development and Consulting

Solutions firm. Mr. Argen built DCC Systems from the ground up, re-engineering

the firm several times to meet the needs of its clientele and enabled DCC

Systems to produced gross revenues exceeding 100 million dollars in

2000.

John

has been a guest speaker at numerous corporate seminars and industry shows. He

has been featured on NBC’s “Business Now” which accredited his Technology

Construction Management methodology as an innovative process for implementing

high tech projects on time and within budget.

Prior to

DCC Systems Mr. Argen held senior management positions at ITT/Metromedia (15

years) and was VP of Engineering & Operations at DataNet, a Wilcox &

Gibbs company (2 years). Throughout his corporate tenure he has worked in

Operations, Marketing, Systems Engineering, Telecommunications and Information

Technology. In a career that spans 30 years e he has had full responsibility for

technology related and construction projects worth over a billion

dollars.

John

Argen graduated Pace University with a BPS in Finance. His commitment to

continued education is reflected in his completion to over 2000 hours of

corporate sponsored courses. Mr. Argen also holds a Federal Communication

Commission (FCC) Radio Telephone 1st Class

License.

-18-

Joseph B.

Hoffman

Mr.

Hoffman, a partner with Kelley Drye & Warren LLP, is a business lawyer with

special focus in telecommunications transactions. Mr. Hoffman's practice

encompasses a wide variety of issues confronting telecom and technology

companies. He advises on purchase and sale of assets and companies as well as

financing transactions, including venture capital, equipment leasing and

institutional, and executive compensation matters.

He also

represents investment companies, real estate developers, lenders and

thoroughbred industry interests with respect to various corporate, financing,

real estate and tax matters. Mr. Hoffman heads up the Commercial Group in Kelley

Drye & Warren's Tysons Corner, Virginia and Washington offices

Jan

Burman

Since

1978, Jan Burman has brought a unique style and personal sensitivity to the

business of real estate development. He has an insight for spotting hidden

opportunities that lesser-trained eyes overlook. This adds up to consistent

results: value for partners, dividends for investors, and outstanding properties

for tenants and buyers. Among his successes: a divestiture of nearly $140

million in holdings to First Industrial Realty Trust; he conceived and developed

LI’s largest independent “golden age” community to date, The Meadows; he

co-developed The Bristal, a growing family of prestigious Assisted Living

communities; and, over the years, he has collaborated on the purchase and/or

development of over 15 million square feet of property, from Canada to Florida.

Jan, also a CPA, is the founder, past president and chairman of ABLI, the

Association for a Better Long Island, which is an aggressive multi-focus lobby

created to protect the economic needs of Nassau and Suffolk Counties. He is also

a member of the Corporate Advisory Council for the School of Management at

Syracuse University, from where he received his MBA.

Biagio

Civale

Mr.

Civale has a long, successful career in Telecommunications and as a

distinguished Arbitrator with both NASD Regulations, Inc. and the American

Arbitration Association. As an Arbitrator over the past 32 years, he has dealt

with issues surrounding the performance of and adherence to contracts and

relationships and responsibilities between and among Clients and

Stockbrokers.

As Vice

President of Business Development for North American Telecom, Mr. Civale created

new business opportunities and alliances around the globe. As Regional Vice

President for RSLCOM, he planned and implemented an international

Telecommunications network inter-connecting 22 countries on four continents.

And, as VP of International Business Development for International

Telecommunications Corporation, he was directly responsible for obtaining

operating agreements with 24 countries and reached 5th

internationally.

Prior to

International Telecommunications Corporation, Mr. Civale held various General

Management positions with a number of International Business Concerns. Mr.

Civale is fluent in 5 languages, has a degree from the University of Pisa and

has studied Law at the University of Florence. Mr. Civale is also a member of

the Data Storage Corporation Board of Directors.

Employment

Agreements/ Terms of Office

None

Family

Relationships

None

-19-

Code

of Ethics

We

currently do not have a code of ethics that applies to our officers, employees

and directors, including our Chief Executive Officer and senior

executives. The company will institute a code of ethics clause into the new

employee manual and directors program, in 2009.

Conflicts

of Interest

Certain

potential conflicts of interest are inherent in the relationships between our

officers and directors, and us.

From time

to time, one or more of our affiliates may form or hold an ownership interest in

and/or manage other businesses both related and unrelated to the type of

business that we own and operate. These persons expect to continue to

form, hold an ownership interest in and/or manage additional other businesses

which may compete with ours with respect to operations, including financing and

marketing, management time and services and potential

customers. These activities may give rise to conflicts between or

among the interests of us and other businesses with which our affiliates are

associated. Our affiliates are in no way prohibited from undertaking

such activities, and neither we nor our shareholders will have any right to

require participation in such other activities.

Further,

because we intend to transact business with some of our officers, directors and

affiliates, as well as with firms in which some of our officers, directors or

affiliates have a material interest, potential conflicts may arise between the

respective interests of us and these related persons or entities. We

believe that such transactions will be effected on terms at least as favorable

to us as those available from unrelated third parties.

With

respect to transactions involving real or apparent conflicts of interest, we

have adopted policies and procedures which require that: (i) the fact of the

relationship or interest giving rise to the potential conflict be disclosed or

known to the directors who authorize or approve the transaction prior to such

authorization or approval, (ii) the transaction be approved by a majority of our

disinterested outside directors, and (iii) the transaction be fair and

reasonable to us at the time it is authorized or approved by our

directors.

EXECUTIVE

COMPENSATION

EURO

TREND INC EXECUTIVE COMPENSATION SUMMARY

Summary

Compensation Table

The following

table shows for the periods ended December 31, 2007 and 2006, compensation

awarded to or paid to, or earned by, our Chief Executive Officer, and our

Secretary/Treasurer (the “Named Executive Officers”).

|

Name

and Principal Position

|

Year

|

Salary

|

Bonus

|

Option

Awards

|

Total

|

|

Peter

O’Brien (1) President, Chief Executive Officer, Treasurer, and

Secretary

|

2007

|

-

|

-

|

-

|

-

|

(1) Peter

O’Brien resigned as our sole officer and director as of the Closing

Date.

Outstanding

Equity Awards at Fiscal Year End

There are no

outstanding equity awards at October 30, 2007.

-20-

DATA

STORAGE CORPORATION EXECUTIVE COMPENSATION SUMMARY

|

12/31/2006

Fiscal Year

|

12/31/2007

Fiscal Year

|

||

|

Name

|

Title

|

Annual

Salary (US$)

|

Annual

Salary (US$)

|

|

Charles

M. Piluso

|

President,

Chief Executive Officer, Chief Financial Officer, Principal Accounting

Officer & Chairman of the Board

|

$

0

|

$

0

|

|

Jason

Nocco

|

Secretary

|

$

79,999

|

$

79,230

|

Director

Compensation

Our

directors will not receive a fee for attending each board of directors meeting

or meeting of a committee of the board of directors. All directors will be

reimbursed for their reasonable out-of-pocket expenses incurred in connection

with attending board of director and committee meetings. It is the intention of

the company to institute a Stock option plan for directors and key employees

during the next twelve months.

Certain

Relationships and Related Transactions

We will

present all possible transactions between us and our officers, directors or 5%

stockholders, and our affiliates to the Board of Directors for their

consideration and approval. Any such transaction will require approval by a

majority of the disinterested directors and such transactions will be on terms

no less favorable than those available to disinterested third

parties.

PRINCIPAL

STOCKHOLDERS

Pre-Closing

The

following table sets forth certain information regarding our common stock

beneficially owned, prior to the closing of the Exchange Agreement, for (i) each

shareholder known to be the beneficial owner of 5% or more of our outstanding

common stock, (ii) each of our officers and directors, and (iii) all executive

officers and directors as a group. In general, a person is deemed to be a

"beneficial owner" of a security if that person has or shares the power to vote

or direct the voting of such security, or the power to dispose or to direct the

disposition of such security. A person is also deemed to be a beneficial owner

of any securities of which the person has the right to acquire beneficial

ownership within 60 days. To the best of our knowledge, all persons named have

sole voting and investment power with respect to such shares, except as

otherwise noted. Except as set forth in this Information Statement, there are

not any pending or anticipated arrangements that may cause a change in control.

Pre-closing, 6,625,000 shares of our common stock were issued and outstanding

immediately prior to the Closing Date.

-21-

|

Name

(1)

|

Number

of Shares Beneficially Owned

|

Percent

of Shares (2)

|

|||||

|

Peter

O’Brien

|

3,000,000

|

45.3%

|

|

||||

|

All

Executive Officers and Directors as a group

|

3,000,000

|

45.3%

|

|

|

(1) The address for

each person is 13 Falcon Hill,

Lovers Walk Tivoli, Cork, Ireland.

|

|

(2) Based on

6,625,000

shares of common stock outstanding.

|

Post-Closing

The

following table sets forth certain information regarding our common stock

beneficially owned on October 20, 2008, for (i) each stockholder known to be the